Why Is The “5,460 Miles from Silicon Valley” Story Still Relevant Today?

The plot in my forthcoming book “5,460 Miles from Silicon Valley” plays out over the years 1984 to 2002. The sale to Microsoft, which was completed about 16 years ago, was the end of Navision Software and Damgaard Data as independent companies.

The plot in my forthcoming book “5,460 Miles from Silicon Valley” plays out over the years 1984 to 2002. The sale to Microsoft, which was completed about 16 years ago, was the end of Navision Software and Damgaard Data as independent companies.

Can you learn anything from something that happened so long ago?

The short answer is: YES.

In an upcoming series of articles, I describe selected highlights from the book, and I discuss their relevance today.

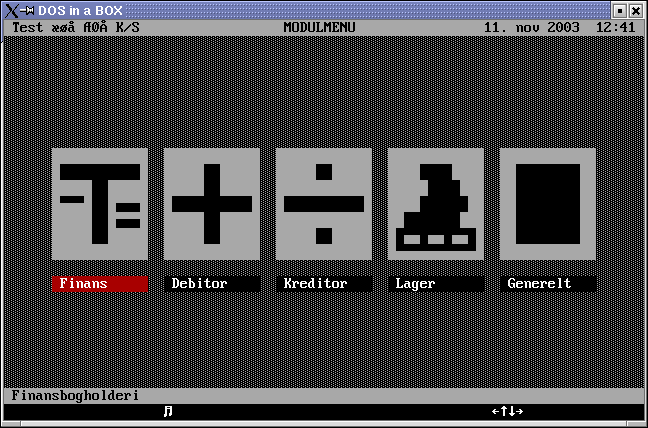

The picture shows Peter Bang (left) and Jesper Balser in Computerworld (the Danish edition) on November 5, 1985. The headline reads “Our ambition is not 117 employees.” Their ambitions were not so outspoken when PC & C and the Damgaard brothers started out.

Startups and funding

Both Damgaard Data, that launched Danmax in 1984, and Navision Software, that launched PCPLUS in 1985, were bootstrapped startups. That is, they started without the support of external investors (but perhaps with a little help from friends and family). As stated in my book, Damgaard Data was profitable within one week of the launch of Danmax, while Navision Software had a loss of USD40,000 in the first fiscal year (November 1984 to April 1986), but achieved a profit of USD 120,000 by the following year.

Neither of the companies received external financial support before their IPOs in 1999.

Bootstrapping is still the most popular startup format

Even though the media (traditional and social) may create a different impression, bootstrapping remains the dominant startup format today. About 90% of all startups do not want or need external investors to get going. Of the 10% seeking outside investors, less than 1% succeeds. Of the 1%, the vast majority get support from so-called business angels, while only very few manage to wring funds out of institutional seed funds.

There are many reasons why most startups avoid external investors, but the four most important ones are:

- They do not need the money.

- They do not want to sell their shares at a low price.

- They do not want to have more decision-makers than necessary and probably not someone with whom they do not have any experience working with.

- It is incredibly time-consuming raising funding for an idea. The hours can be used to improve the product and get paid customers instead.

You scale sooner and faster today

Today, on the other hand, it is almost standard practice to raise funding when the business model has proven watertight and needs scaling. As the book explains, Damgaard Data took eight years to reach a turnover of USD 20 million, while Navision Software spent 12 years on the job. If the two companies were started today, they would soon be contacted by investors who would be ready to invest in faster growth. And the tougher competitive pressures of today would probably also have Preben Damgaard and Jesper Balser listen more carefully than they did then. Both companies received several offers that they turned down.

Today, on the other hand, it is almost standard practice to raise funding when the business model has proven watertight and needs scaling. As the book explains, Damgaard Data took eight years to reach a turnover of USD 20 million, while Navision Software spent 12 years on the job. If the two companies were started today, they would soon be contacted by investors who would be ready to invest in faster growth. And the tougher competitive pressures of today would probably also have Preben Damgaard and Jesper Balser listen more carefully than they did then. Both companies received several offers that they turned down.

In January 1994, Damgaard Data made a joint venture agreement with IBM, which had a slight touch of a funding element. But as the book explains, it was far more complicated than that. The joint venture did not work well and ended in a divorce. I will provide more details in an upcoming article.

The IPOs described in the book are performed the same way today. Although it is now a precedent that non-profitable companies can also be listed. The Navision Software IPO was the role model. Damgaard Data’s not so much.

It takes a team to start a business

The picture shows the three PC&C founders Jesper Balser (left), Peter Bang, and Torben Wind (without suits). It’s Carl Christian Ægidius and Ole Anker Larsen from IBM both wearing the traditional dark suits. The photo is from October 1987, when IBM was appointed exclusive distributor of Navigator in Denmark.

The picture shows the three PC&C founders Jesper Balser (left), Peter Bang, and Torben Wind (without suits). It’s Carl Christian Ægidius and Ole Anker Larsen from IBM both wearing the traditional dark suits. The photo is from October 1987, when IBM was appointed exclusive distributor of Navigator in Denmark.

Over the last 20 years, it has become the standard belief that companies with more than one founder are more likely to survive. The quality of the team behind a good idea is more important than the idea. Most “good” ideas turn out to be not so good, after which the team changes direction and builds another successful business instead. There are shared opinions, but it is still recommended to have more than one founder.

Erik and Preben Damgaard started Damgaard Data and the book documents in detail the strength of this partnership. Navision Software (from 1985-1995: PC & C) was founded by Jesper Balser, Peter Bang, and Torben Wind – also a team with complementary skills.

As the companies grew, more executives were recruited to manage the expansion. At Navision Software, it was Erik Seifert and René Stockner, as well as the three founders of the German “subsidiary,” which played crucial roles, while at Damgaard Data Bo Nielsson, Per Pedersen and later Freddie B. Jørgensen left noticeable fingerprints.

In addition to a small and tight team to start a business, continued growth demanded the ability to find and delegate responsibilities to people who could take on new tasks and complement the capacity and competencies of the founders. Today, this ability to recruit and hold on to the right employees is an essential component of the recipe for success. What is right is situational and changes over time.