Digital Bosphorus: The State of Turkish eCommerce 2013

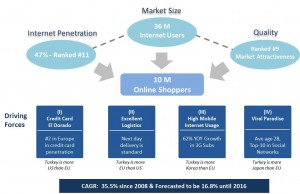

The Turkish eCommerce is one of the fastest growing internet economies in the world. Istanbul is the capital city of the Turkish internet and attracts more and more outside talent. There are four main driving forces behind this growth: Credit Card Penetration, Logistic infrastructure, high mobile internet usage and a viral / social young population.

So, this mix of different driving forces makes Turkey exciting but also competitive. It is easy to launch a business as you start with a good infrastructure (in opposite to Eastern European countries or MENA countries). Turkey had 36 M internet users and an estimated 10 M Online Shoppers.

The General Overview of Turkey’s eCommerce space and the driving forces[1]:

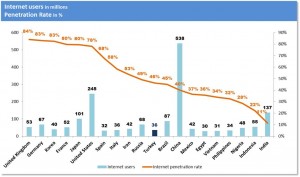

With 36 M internet users, Turkey is in the top 20 for Number of Internet Users and ranks No. 11 in internet penetration[2].

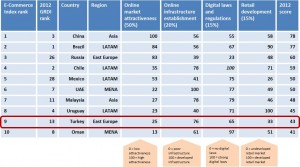

Another very important aspect is the rise of Turkey in the qualitative rankings. Usually Turkey was always very promising on the quantitative dimension but lacking in the qualitative one. This has changed. Many Audit or Consulting companies have different rankings; please find here the AT Kearney 2012 eCommerce İndex[3]:

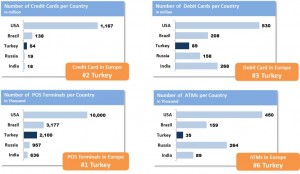

Lets drill the driving forces down and start with driving force No. 1- credit card penetration. Even the four different statistics show how developed the payment infrastructure in Turkey is. Especially the high credit card penetration or number of POS terminals in Europe. Turkey is always among the top countries[4].

The other driving force is the excellent logistic infrastructure of Turkey – especially the number and quality of the delivery companies for the last mile[5].

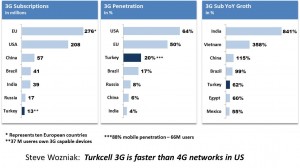

The next driving force is the Mobile Penetration which is already changing everything in which we have believed until 2012[6].

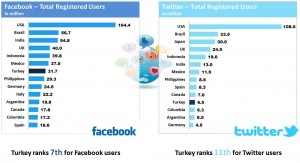

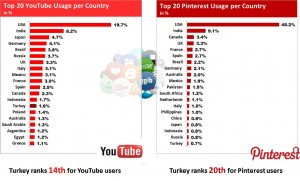

Last but not least, Turkey is a viral paradise and is in all social media among the top performers[7]:

***

The volume behind this market with its driving forces is big and provides the potential to become much much bigger than today.

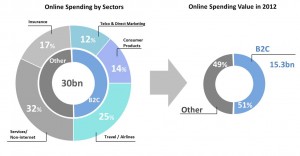

The only reliable method to have an estimation on the eCommerce volume starts with the BKM data. As we know, not all registered transactions are directly linked with internet transactions. If we exclude this kind of transactions, we believe that Turkey had in 2012 a eCommerce volume (including travel, classifieds revenues, marketplace GMV, dating) of 15.3 B TL (8.6 B USD). This is the widest definition of the Turkish eCommerce. If we narrow this to classic B2C players (like all eTailers with warehouse), our estimation is 5 B TL in 2012[8].

The Future is bright.

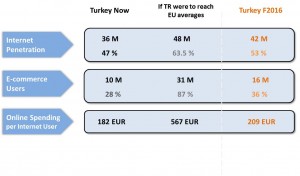

The potential of Turkey’s eCommerce is big. As all big countries, also Turkey is on a convergence to the averages of the more developed countries. Taking this as the starting point for our prediction, let’s have a look what would be if Turkey reaches the averages of the European Union countries:

Turkey would have 48 M internet users, 31 M ecommerce users and a volume which is times five of today.

My expectation on the very right is much more conservative but still triples the market. Believing this scenario means to expect 16.5% CAGR until 2016.

Reprinted with permission from Sina Afra

[1] Source: Euromonitor, http://internetworldstats.com, Internation Telecommunication Union, Planet Retail, World Bank, World Economic Forum; A.T. Kearney analysis, Euromonitor, http://www.bkm.com.tr, http://www.slideshare.net/kleinerperkins/ kpcb-internet-trends and estimations.[2] Source: http://internetworldstats.com [3] Source: Euromonitor, Internation Telecommunication Union, Planet Retail, World Bank, World Economic Forum; A.T. Kearney analysis [4] Source: http://www.utikad.org.tr/haberler/?id=8473 [5] Source: http://www.utikad.org.tr/haberler/?id=8473 [6] Source : Turkcell; http://www.gencbusiness.com/gbp-haberleri/2046_cepten-internete-girenlerin-say%C4%B1s%C4%B1-artarken.html;Sureyya Ciliv — http://www.dld-conference.com/news/dld-events-related/dld-bosporus-one-night-in-istanbul_aid_3380.html;http://en.teknoblog.com/communication/steve-wozniak-turkcell-3g-is-faster than-4g-networks-in-us.html;http://www.slideshare.net/kleinerperkins/kpcb-internet-trends-2012 [7] Source: http://semiocast.com/publications/2012_01_31_Brazil_becomes_2nd_country_on_Twitter_superseds_Japan, Socialbakers, http://www.appappeal.com/maps/facebook, Pinterest http://www.appappeal.com/maps/pinterest, http://www.appappeal.com/maps/youtube [8] Source: BKM and own analysis