Bad Blood: Secrets and Lies in a Silicon Valley Startup

Books like Bad Blood: Secrets and Lies in a Silicon Valley Startup are the main reason I do not read much fiction. Again and again, the reality surpasses the imagination. Had Bad Blood been fiction, many readers would have judged the plot to be completely unrealistic. To fool so many notorious industry and political (and probably intelligent) celebrities for so long could not happen in reality.

Books like Bad Blood: Secrets and Lies in a Silicon Valley Startup are the main reason I do not read much fiction. Again and again, the reality surpasses the imagination. Had Bad Blood been fiction, many readers would have judged the plot to be completely unrealistic. To fool so many notorious industry and political (and probably intelligent) celebrities for so long could not happen in reality.

However, it did – in broad daylight.

Bad Blood is the story of Theranos, a Silicon Valley startup whose charismatic female founder, Elizabeth Holmes, over 15 years, managed to raise close to one billion dollars from prominent investors including Larry Ellison and Rupert Murdoch, won hotshots such as Henry Kissinger and James Mattis for her board and was appointed Ambassador of Global Entrepreneurship by President Obama before The Wall Street Journal, with deep-digging journalism, started a process ending up documenting that the company was not only based on lies, falsehood, bullying and fraud but also endangered human life.

How could it happen?

It could happen because Theranos had all the right attributes, that Silicon Valley – and all other entrepreneurial environments for that matter – love and for which they are always on the outlook.

Disruption is the password

A good Silicon Valley idea should ideally be disruptive. That is, it has to pull the rug from under an already established industry. With investor’s eyes a disruptive idea has several attractive features:

A good Silicon Valley idea should ideally be disruptive. That is, it has to pull the rug from under an already established industry. With investor’s eyes a disruptive idea has several attractive features:

- It solves an already recognised need

- It offers a superior price/performance ratio

- It addresses a huge market

- It can spread very quickly

- The first mover will often clear the table

Ideas that have disruption potential have the immediate attention of venture capitalists. This is because such ideas are rare and because they can compensate for all the investments that fail. Even in Silicon Valley, most investments fail.

Save the world

If you have an idea with both the potential for undermining an entire industry while at the same time addressing a humanitarian challenge, then there is no end to what attention it can attract.

If you have an idea with both the potential for undermining an entire industry while at the same time addressing a humanitarian challenge, then there is no end to what attention it can attract.

Silicon Valley is the cradle for major global commercial successes, whose contribution to humanity is somewhat limited. Google, Facebook, Twitter, Airbnb and Uber are good examples.

Therefore, there is always the demand for something that can both make massive profits and unquestionably benefit humanity. They are extremely rare, so when one finally pops up, it raises eyebrows.

A woman at the top

Silicon Valley has a well-deserved reputation for being a male-dominated world. This does not sit well with its libertarian self-view. Should the creative forces of the market get free rein, it should manifest itself in diversity and benefit the whole community. It seldom does.

A disruptive business idea packaged to save lives and invented by a young and charming woman is no less than a godsend.

Greater than God

Entrepreneurship is carried out by charismatic individuals who think not only big but gigantic. With an iron will and persistence, they overcome all the adversity, all the aversion and all the opposition this world can muster to eventually achieve victory, change the world and become so rich that they do not have to work for a thousand years.

Entrepreneurship is carried out by charismatic individuals who think not only big but gigantic. With an iron will and persistence, they overcome all the adversity, all the aversion and all the opposition this world can muster to eventually achieve victory, change the world and become so rich that they do not have to work for a thousand years.

People such as Bill Gates, Elon Musk, Richard Branson and especially Steve Jobs are the role models. They are super intelligent and capable not only of foreseeing the future, but of creating it themselves.

To spot these opportunities before they grow too big is the challenge and the task. If you get the opportunity to invest early, then you will enjoy ridiculously attractive returns in just a few years. Good indications of a Silicon Valley Messiah are the ability to think very big with an idea that it is easily understood. If someone else mentions the person positively and you can read about him or her in the big magazines and on your favourite blogs, then it is also easier and faster to reach the same conclusion.

Start with why

A great Silicon Vally idea must affect billions of people. It must be driven by a higher purpose than just making money. It must be sustainable. Of course, lots of money is required for realising the vision, but making money is secondary. It is the purpose, the vision, the mission and the great “WHY?” that drives the people and the project.

A great Silicon Vally idea must affect billions of people. It must be driven by a higher purpose than just making money. It must be sustainable. Of course, lots of money is required for realising the vision, but making money is secondary. It is the purpose, the vision, the mission and the great “WHY?” that drives the people and the project.

The formula is: First, identify the altruistic WHY. It should be something that is undeniably beneficial to humanity. Then you must quickly and easily explain the HOW, i.e. how to deliver the big vision. Only then do you need to outline the WHAT, which are the details of the product or service you will deliver. The WHAT are the technical details, that can be sorted out by the engineers.

Theranos had it all

When the very diligent, gifted and eloquent 19-year-old Elizabeth Holmes, in the fall of 2003, decided to drop out of her sophomore year at Stanford University, it was because of an idea she had during a stay in Singapore earlier that year, while working to analyse samples from potential SARS victims. It was a cumbersome, slow and expensive affair. There must be a way to do it faster, easier and cheaper.

When the very diligent, gifted and eloquent 19-year-old Elizabeth Holmes, in the fall of 2003, decided to drop out of her sophomore year at Stanford University, it was because of an idea she had during a stay in Singapore earlier that year, while working to analyse samples from potential SARS victims. It was a cumbersome, slow and expensive affair. There must be a way to do it faster, easier and cheaper.

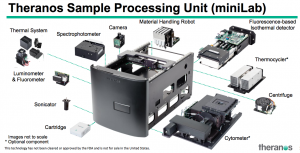

Just as it had been possible to scale down large computers to microprocessors that cost a fraction, it should also be possible to develop analysers requiring only a tiny amount of input and at the same time being able to perform many more analyses in just a few cycles. Smaller, faster and cheaper. By linking several technologies, Elizabeth Holmes developed her idea for a small device, using a few drops of blood from the tip of your finger to carry out a variety of analyses quickly. She showed her professor, in whose laboratory she was a student assistant, her notes. He was duly impressed; impressed by her ambition, energy, initiative and ability to comprehend so many technologies. The apparatus itself was outside of his field of expertise, but Elizabeth was, in particular, an exceptional student.

With a 25-page conceptual description of a device that was supposed to be used in people´s homes, help diagnose diseases faster and thus save lives, she used her family and friends to reach out to wealthy investors who volunteered a few million dollars to the project. When the Red Herring technology magazine, at the end of 2005, awarded the company, now called Theranos, the title The Hottest Startup in The Valley, the road was paved for one of the greatest scams of this century.

Passionate, uncompromising and endorsed

That Elizabeth was passionate and uncompromising in the mission to save humanity was seen as one of two crucial virtues for the people she managed to win for her cause. The other virtue was that someone before them had already endorsed her and the project.

Larry Ellison, founder of Oracle

Virtually no one could figure out whether or not it was feasible to develop such a device. However, when the professor had endorsed her (he soon became affiliated with Theranos as a consultant and received a payment of 1/2 million dollars a year) and the first celebrity investors, including Oracle’s Larry Ellison, had put their money on the table, then who are you to question the business case?

Step by step, Elizabeth, through her network, got in touch with more well-known people, who introduced her to even more famous people, which eventually led to an honorary position as the Ambassador for Global Entrepreneurship with President Obama’s administration. When her board consisted of people like Henry Kissinger, James Mattis, Bill Perry, George Shultz, Dick Kovacevich, Riley Bechtel and Gary Roughead, she was one of America’s most well-connected entrepreneurs.

The inner logic of endorsement and recognition

One magazine after another crowned her as Entrepreneur of the Year and other top-of-the-pops recognitions. She became a frequent keynote speaker at the major tech conferences. Here she talked about her visions – her WHY (and not about her products and technology – her WHATs), and that’s exactly what the audience came to hear about: Technology saving the world.

One magazine after another crowned her as Entrepreneur of the Year and other top-of-the-pops recognitions. She became a frequent keynote speaker at the major tech conferences. Here she talked about her visions – her WHY (and not about her products and technology – her WHATs), and that’s exactly what the audience came to hear about: Technology saving the world.

In the same way as she won attention and recognition, investors were lining up to get onboard. The fear of missing out far exceeded the risk that the project would not succeed.

The brilliant business model

A small, low-cost device that can perform 240 tests on just a few drops of blood from the tip of a finger and deliver the results significantly faster than existing methods can be applied in numerous contexts. However, that supermarkets such as Safeway and drug stores such as Walgreens contributed to the business model was nothing short of a stroke of genius.

Safeway and Walgreens were retail chains exposed to high pressure looking for innovative ways to cope with the increased competition from, not least, the e-commerce insurgents. Setting up blood sampling facilities in their stores could provide a vital revenue generating service that would also attract new customers. At the same time, Safeway and Walgreen’s were famous names capable of putting large amounts on the table in exchange for the rights to use Therano’s technology. Walgreen thus paid a $100 million innovation fee and provided a $40 million loan against Theranos’s commitment to deliver a large number of devices (not yet developed) on a particular date.

Safeway and Walgreens were retail chains exposed to high pressure looking for innovative ways to cope with the increased competition from, not least, the e-commerce insurgents. Setting up blood sampling facilities in their stores could provide a vital revenue generating service that would also attract new customers. At the same time, Safeway and Walgreen’s were famous names capable of putting large amounts on the table in exchange for the rights to use Therano’s technology. Walgreen thus paid a $100 million innovation fee and provided a $40 million loan against Theranos’s commitment to deliver a large number of devices (not yet developed) on a particular date.

Through her relationships with the highest ranking generals and admirals in the Pentagon, Elizabeth Holmes lobbied for the use of her apparatus for action in the field. Even though she had support from within, Theranos never succeeded in reaching an agreement with the United States’ armed forces. Those in charge of validating her technology spotted the lack of substance and stepped on the brakes. However, with so many generals and admirals on Theranos’ board, everyone concluded that such agreements were already in place.

Through her relationships with the highest ranking generals and admirals in the Pentagon, Elizabeth Holmes lobbied for the use of her apparatus for action in the field. Even though she had support from within, Theranos never succeeded in reaching an agreement with the United States’ armed forces. Those in charge of validating her technology spotted the lack of substance and stepped on the brakes. However, with so many generals and admirals on Theranos’ board, everyone concluded that such agreements were already in place.

The house of cards is falling down

If Elizabeth Holmes was visionary, charming and eloquent externally, then internally she was dictatorial, unempathetic, moody, irrational, paranoid and merciless. Although her device was technically impossible to develop, her leadership and management style also made it very difficult to make just a little headway (as the fraud was revealed, the device could perform just 15 of the 240 tests that the specifications promised). To keep the ship floating, she instead turned into a bully, lie and a cheat.

While on the one hand investing vast amounts of time nursing her public image as a wonder woman – with the help of one of America’s most reputable law firms – Holmes spent almost all her remaining time building watertight shutters in her organization and with stakeholders, so only she and her boyfriend (who was also the company’s chief operating officer) had the full overview. Claiming the need to protect the company’s business secrets, she managed to keep all other stakeholders unaware that her device did not work and that it was unclear how long it would take and how much money it would cost to complete it.

While on the one hand investing vast amounts of time nursing her public image as a wonder woman – with the help of one of America’s most reputable law firms – Holmes spent almost all her remaining time building watertight shutters in her organization and with stakeholders, so only she and her boyfriend (who was also the company’s chief operating officer) had the full overview. Claiming the need to protect the company’s business secrets, she managed to keep all other stakeholders unaware that her device did not work and that it was unclear how long it would take and how much money it would cost to complete it.

High staff turnover will at some point lead to problems, and it was a whistleblower among former employees who created the first small cracks in the otherwise bright and shiny surface.

The article in The Wall Street Journal

The article about Theranos published in The Wall Street Journal on October 16, 2015, had been a long time coming. The journalist, John Carreyrou, who is also the author of the book, first got acquainted with the problems in February the same year. In addition to very thorough research, he and the WSJ, however, came to spend much time fighting Theranos lawyers, who made all efforts to slow down his work and kill his article. That part of the book alone is more nerve-racking than any thriller and apparently also the perfect description of what you should be prepared for if you want to do business in the United States. It’s not for delicate souls and can require bottomless pockets, even for those who have done nothing wrong.

The article about Theranos published in The Wall Street Journal on October 16, 2015, had been a long time coming. The journalist, John Carreyrou, who is also the author of the book, first got acquainted with the problems in February the same year. In addition to very thorough research, he and the WSJ, however, came to spend much time fighting Theranos lawyers, who made all efforts to slow down his work and kill his article. That part of the book alone is more nerve-racking than any thriller and apparently also the perfect description of what you should be prepared for if you want to do business in the United States. It’s not for delicate souls and can require bottomless pockets, even for those who have done nothing wrong.

The rest of the story and many more details can be found in John Carreyrou’s fantastic book. It is thoroughly researched, well written and presents people and events that you in your wildest imagination would not believe existed.

However, they do.

Bad Blood: Secrets and Lies in a Silicon Valley Startup

Title: Bad Blood: Secrets and Lies in a Silicon Valley Startup

Number of pages: 352

Author: John Carreyrou

Publisher: Knopf

Date of release: 21 May 2018

Prices: $15,21 for Kindle or $13,51 as paperback

Recommendation: My sincere recommendations for anyone interested in entrepreneurship and business in general.

Review: The book has more than a thousand positive reader reviews

Update on January 3rd 2022

A jury found Elizabeth Holmes guilty of defrauding investors out of hundreds of millions of dollars.

After more than 50 hours of deliberations over seven days, the jury convicted Holmes of three counts of wire fraud and one count of conspiracy to commit wire fraud for lying to investors about devices developed by Theranos, the once high-flying biotech company that she started at the age of 19.

The jury found Holmes not guilty on four other fraud-related charges connected to allegations that she duped patients who received false or faulty results from tests conducted by Theranos, which collapsed in 2018.

The jury could not reach a unanimous verdict on three other counts tied to investor fraud. U.S. District Judge for the Northern District of California in San Jose, Edward Davila, is expected to declare a mistrial for those three counts. It is unclear whether prosecutors intend to indict her again for those charges, a possibility allowed under federal law.

Source: NPR