Choosing Foreign Markets in the Software Industry – 3

This series of posts discusses how to choose foreign markets in the software industry.

This series of posts discusses how to choose foreign markets in the software industry.

Links to previous posts in this series are listed at the end of this post.

Entering a foreign market in the software industry is a very strategic decision. Finding, winning, making, keeping and growing customers in foreign countries requires establishing infrastructures, which can drive the marketing and sales processes as well as the implementation and support activities. Customers in foreign markets will be reluctant to do business with us unless we can demonstrate a solid commitment for the long haul.

A competitive product is not enough.

The Process of Choosing Foreign Markets

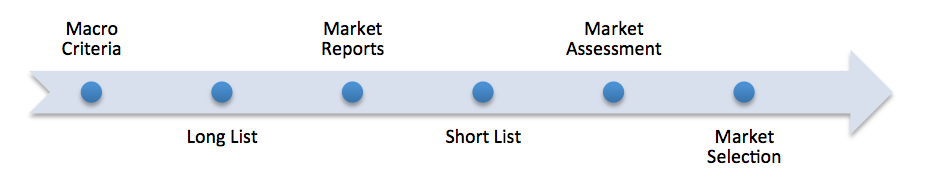

We concluded the previous post by listing the steps required for choosing foreign markets using a systematic and intelligent approach:

Let’s review each of the steps in detail.

Macro Criteria

Our business model and our business model environment will provide us with some high level criteria helping us in qualifying markets and will produce the long list of countries that could be potential markets.

I recommend starting the process by applying Bech’s 1st Law and Bech’s 2nd Law.

Bech’s 1st Law

Having worked and sold software in most corners of the world I have come to realize what I now call Bech’s 1st Law.

Bech’s 1st Law: The cost of sales increases exponentially with the distance to the foreign market.

This phenomenon complies with the economic principles of social physics, which explains why most countries in the world have their immediate neighbours as their most important trading partners.

A software company located in Copenhagen can reach the Nordics and most of the Central European markets within 2 hours. There is a maximum 1-hour time difference in each direction making communication convenient.

A software company located in Copenhagen can reach the Nordics and most of the Central European markets within 2 hours. There is a maximum 1-hour time difference in each direction making communication convenient.

23% of the global demand for software and software related services is represented within 2 hours flight from Copenhagen. However, it is spread across 24 countries with 22 different languages.

The advantage that software companies from smaller countries enjoy is their experience with operating in market environments substantially different from their own home turf. Combining this experience with business acumen can outsmart even the large investment budgets that software companies from bigger markets enjoy.

Social physics remains a good guideline for short-listing foreign markets in the early days of internationalization even when the neighbouring countries are small markets.

Bech’s 2nd Law

Bech’s 2nd Law: Bigger markets are more difficult than smaller markets

I admit that my perspective is biased by my experience. My operational experience has mainly been garnered taking software companies from small domestic markets to bigger international markets.

That’s going global on a shoestring.

Getting 20% market share in Norway comes much faster than the 20% in Germany or France (not to speak of the USA).

With unlimited resources any software company would choose the bigger markets first and then move to new markets determined by market size.

If you are short on funds and resources you will prefer a small market with an immediate fit as opposed to a large market with a poor fit. You will dream of the large market with the perfect fit, but with limited funds big markets are always tougher to conquer irrespective of how good you believe the fit is.

Table 1 lists the 25 biggest markets for software and software related services in world. Source: The BECH Index 2013

A strategy based on taking the markets according to their generic potential would direct all the software companies in the world to the USA first. The reason this does not happen is exactly due to Bech’s 1st and 2nd Laws.

The history of the software industry is full of horror stories of companies losing massive amounts of money attempting to capture the US market. One of the most prominent examples is Swedish Intentia’s attempt at the end of the last century. In spite of investing heavily for more than 5 years, Intentia never managed to grow the share of revenue in the US to more than 4% of total revenue before Lawson acquired it in 2005.

Big markets look tempting from the outside, but are very difficult to penetrate.

Other posts in this series:

Choosing Foreign Markets in the Software Industry – 1

Choosing Foreign Markets in the Software Industry – 2

Choosing Foreign Markets in the Software Industry – 4

Choosing Foreign Markets in the Software Industry – 5