How Cloud Computing Is Redefining the M&A Landscape

In 2013, expect to see the pace of mergers and acquisitions for cloud computing, mobile and analytics technologies accelerate as software vendors look to fill gaps in their product and service strategies. This and other key insights of how cloud computing is reshaping the merger and acquisition landscape can be found in the latest Price Waterhouse Coopers (PwC) report.

The US Technology M&A insights: Analysis and Trends in US Technology M&A Activity 2013 provides an excellent overview of merger, acquisitions, private equity, divestures, cross-border transactions across the five key industry sectors. The report, free for download, covers the Internet, IT Services, hardware and networking, software, and semiconductor sectors.

The major catalysts driving cloud deals forward in 2013 are enterprise software companies’ need to redefine their business models and find sources of sticky revenue that can replace for many of them, dwindling maintenance revenue streams. Knowing that the annuity model of cloud computing works best with multiyear payments required at the beginning of a customer engagement, enterprise software companies are looking to strengthen this area of their product portfolios. Third, the faster cloud acquisitions can be integrated into their legacy systems, the more upsell can be achieved with their large installed bases of customers. The greatest challenge many of them face however is selling entirely new cloud applications to entirely new customers they’ve never sold to before. The potential of these entirely new markets however is going to be a valuation multiplier in 2013 and beyond.

Here are the key take-aways from PwC’s report:

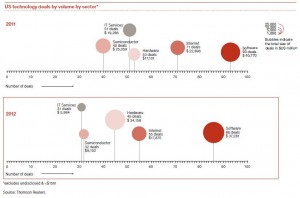

- Software and Internet deals represented 57% of transactions closed in 2012, a figure that PwC has seen steadily grow over the last two years. Cumulative value for software and Internet deals represented 53% of total 2012 deal value, an increase from 51% in 2011. Software deals represented over a third of 2012 technology deals, generating 35% of deal volume and 36% of deal value for the year A comparison of both years and technology sectors are shown in the following graphic:

- PwC takes a cautionary, conservative tone in this report showing how overall IT spending growth finished the year at an anemic 1.2% while technology deal volumes and values dropped by just under 20% from the prior year.

- The report cites Gartner and Forrester’s optimistic IT spending forecasts for IT growth predicting a recovery in 2013 followed by accelerating growth in 2014 according to Forrester.

- PwC is seeing SaaS, mobile devices, analytics and Big Data as the drivers of current and future M&A growth and a fundamental shift in deal volumes to software and Internet deals based on these technologies. The report says the most promising areas of M&A activity in 2013 are mobile application development start-ups who have the intellectual property it would take years for enterprise software companies to create on their own.

- Analytics will move from being a differentiator to the cost of doing business, a key point made in the PwC analysis. PwC claims that analytics M&A will accelerate across all enterprise software vendors as they seek to fill gaps in their product and service strategies, and position themselves for growth in specific areas of the emerging industries using Big Data.

- PwC reports that monthly deal volumes for software remained relatively even throughout 2012, hovering at 8-9 transactions per month and averaging just over 20 per quarter. The average deal value of $433M for 2012 was slightly lower than 2011 levels of $438M but an increase in the number of deals in excess of $500M helped to keep average deal values high. The report also shows how 2012 saw 18 deals (21% of volume) in excess of $500M closed, the majority of which closed in the latter half of the year. Fourteen deals greater than $1B closed in 2012, an increase of 8 deals (133%) over 2011. The following is a graphic comparing software sector deals by volume and value:

Bottom line: The land grab is on for intellectual property in the fields of mobile application development, analytics and cloud computing as enterprise software vendors look to fill gaps in their product and service strategies.