Using the Business Model Environment for Export Market Assessments – Part 2

In this series of posts, I provide a simple approach for making a fast yet fairly comprehensive assessment of a foreign market (that you have short-listed among the many opportunities available to you). This assessment will indicate which adjustments you need to make to your business model and to your go-to-market approach to become successful in that market (country).

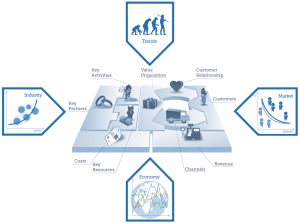

The Four Business Model Environment “Forces”

In order to help us make a structured and systematic analysis Alexander Osterwalder has divided the business model environment into four major areas:

In order to help us make a structured and systematic analysis Alexander Osterwalder has divided the business model environment into four major areas:

- Key Trends

- Market Forces

- Industry Forces

- Macro-Economic Forces

Osterwalder actually names these areas “forces”, which in my opinion may confuse them with Porter’s “Five Forces”[1] to which there is some overlap.

However, Osterwalder’s four business model environment areas are fairly comprehensive and complete and will work well for most information technology companies.

Key Trends

- Technology Trends

- Regulatory Trends

- Societal & Cultural Trends

- Socioeconomic Trends

No two countries are alike end even the big countries may have substantial regional differences.

The questions you could ask concerning the Trends part of the business model environment are:

- Are the technology platforms for your business model in place?

- Are there legal issues that require changes to your products and services?

- Are there legal issues that require changes to your revenue generation[2] process?

- How will differences in language impact your business model?

- How will “the distance to the market” impact your business model?

- Do customers and business partners have different behavioural patterns (culture) that may impact the performance of your revenue generation process?

Market Forces

- Market Issues

- Market Segments

- Needs & Demands

- Switching Cost

- Revenue Attractiveness

The market forces include all issues associated with the size and nature of the demand for your type of products and services. Experience proves that assuming that customers in a new market have the exact same characteristics as the customers in your domestic market can lead to major mistakes, lost investments and lost opportunities.

You will, therefore, need to assume that there are differences in the market forces in each new geography you decide to enter.

Key issues to consider when moving into a new market are:

- How big is the market for your products and services?

- Is this market growing, flat or shrinking?

- Is what you offer considered more or less important in the new market compared with your domestic market?

- What may prevent potential customers from buying your product/service?

- What are the switching costs for customers who may be attracted to your value proposition?

- Where do your potential customers go for information about the type of issues you address and who do they listen to for recommendations?

- Are there specific market requirements that you must be able to cover in your product and services?

- Are there specific ways the market acquires products and services like yours that require changes to your revenue generation process?

Industry Forces

- Competitors (incumbents)

- New Entrants (insurgents)

- Substitute Products & Services

- Stakeholders

- Suppliers & Other Value Chain Actors

The industry forces include all issues associated with the supply of products and services similar to yours. All your potential customers in a new geography are running their businesses without your product and service, which makes it fair to assume that you will have competitors and that your potential customers have substitution alternatives.

Stakeholders are people in organizations that have an influence on your business model without being customers. Stakeholders are typically your new staff, labour unions, shareholders, industry associations, the government, lobbyists, consultants, analysts and the media.

The industry forces also include the channels through which the customers are served, the influencers, the organizations and the media dealing with these domain issues.

Key issues to consider when moving into a new market are:

- Who are the main direct competitors in the segments that you plan to address?

- What are the strength and weaknesses of these competitors?

- Do their weaknesses leave enough room for your value proposition to be sufficiently attractive to the market?

- Do you need to narrow your market focus[3] to remain sufficiently competitive?

- Are there any other new entrants[4] pushing the same value propositions as yours? Can you leverage[5] their efforts?

- Who are the main influencers, organizations and media dealing with your domain?

- Can you find “friends” among the influencers, organizations and media that will promote your value proposition?

- Who are the channel players in your domain?

- Can you find channel players that can profit from the success of your value proposition and approach?

Macro-Economic Forces

The macro-economic forces include:

The macro-economic forces include:

- Global Market Conditions

- Capital Markets

- Commodities and Other Resources

- Economic Infrastructure

Macro-economic forces are highly unpredictable and may change quickly. The macro-economic forces should therefore seldom have any significant importance for your considerations concerning entering new markets. Achieving any significant position in a new market is typically at least a 3 to 5-year project and within such a time frame the macro-economic forces may have changed completely.

Big consulting companies may make predictions on the development of certain countries and regions and may appoint these regions as future growth centres. Such predictions were made in 2001 for Brazil, Russia, India and China under the label BRIC and in 2014 the MINT countries (Mexico, Indonesia, Nigeria and Turkey) were named the new growth countries. None of the predictions has been solid. The economic climate and the political situation can change the predictions with very short notice.

Small companies with little international experience, limited capital resources and a shortage of management and leadership capacity should first focus on developed and stable markets that are not too far away.

[1] Porter, Michael E. 1980. Competitive Strategy: Techniques for analyzing industries and competitors (Free Press: New York).

[2] Revenue generation includes business development, marketing, sales development, sales, account management and customer success activities

[3] When you move into new countries that are substantially bigger than your domestic market, then you will typically face competitors that are more specialized and focused than you currently are.

[4] New entrants can be more difficult to identify than the established competitors.

[5] Working with someone pushing the same message as yours may create a bigger buzz than if you have to do the job all on your own.