Strategy for software Dummies – part 6

A strategy framework for growing a software company from a local to a global player

The title for this series of posts is inspired by the extensive series of instructional/reference books, which serve as non-intimidating guides for readers new to the various topics covered, or for readers who need a solid brush up. The title doesn’t imply that software CEO’s are Dummies; only that there is a need for a new type of “strategy framework” that produces more than fluff and which can be completed in a very short time.

This post #6 explain how the ABC Company defines their Customer Value Proposition TODAY.

A recap from post#5.

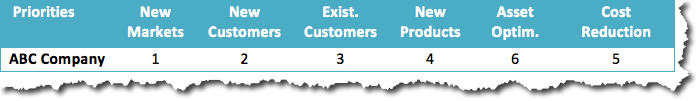

The ABC company is an Independent Software Vendor planning to go global. They have asked a ValuePerform consultant to help them put an international Go-To-Market plan together. The ValuePerform consultant wants to know the current position of the ABC company before any work on future strategies commences. It turns out that the management team wildly disagree on the priorities for financial performance. The consultant explains why the priorities must be made and the CEO and VP of sales have agreed to make the final priorities. The CEO and the VP of Sales meet and after 2 hours of discussion they agree on the following priorities:

Do we agree?

These priorities are presented by the CEO and VP of Sales at the next workshop where the entire management team is present. The ValuePerform consultant asks the management team if they agree? Some nod, some say yes and some don’t say anything. The consultant now asks each of the management team members to clearly state their position. It turns out that the CTO and the VP of Professional Services still disagree. They have a hard time accepting that “new products” get the 4th priority. It is now agreed that the CEO, the VP of Sales, the CTO and the VP of professional services must clarify the issue.

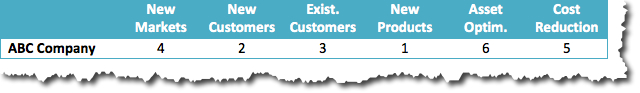

After a week and with help from the ValuePerform consultant they return with a new set of priorities:

The rationale is the following: The ABC Company is just about to launch a new product, which in reality is a replacement of their current product. The new product is not backwards compatible. It is highly unlikely that there will be any demand for the current product as soon as the new product is released. Current customers will not want to migrate to the new product immediately. The migration cost will be substantial. It will require substantial changes in their business situation before a business case can justify the migration. To avoid competitive attacks and animosity from the installed base the ABC company must continue supporting the current product and provide very attractive migration license packages to existing customers. The CEO, VP of Sales, the CTO and the VP of professional services agree that current customers must be made comfortable with using the current product until the time where their own business situation calls for a change.

The rationale is the following: The ABC Company is just about to launch a new product, which in reality is a replacement of their current product. The new product is not backwards compatible. It is highly unlikely that there will be any demand for the current product as soon as the new product is released. Current customers will not want to migrate to the new product immediately. The migration cost will be substantial. It will require substantial changes in their business situation before a business case can justify the migration. To avoid competitive attacks and animosity from the installed base the ABC company must continue supporting the current product and provide very attractive migration license packages to existing customers. The CEO, VP of Sales, the CTO and the VP of professional services agree that current customers must be made comfortable with using the current product until the time where their own business situation calls for a change.

It makes no sense to start the penetration of new markets with the current product, and it makes no sense to penetrate new markets with a new product, which has no traction in the domestic market. The CEO, VP of Sales, the CTO and the VP of professional services agree to postpone the internationalization project for 18 months. Market assessments, probing and intelligence can be commenced, but investments in bootstrapping activities in new markets must await a certain acceptance of the new product in the domestic market.

The top priority must be given to having the new product accepted by new customers in the domestic market. There is a pipeline of potential customers, which will consider the new product anyway. Securing these deals must be given the highest priority. Protecting the installed base from competitive attacks based on perceived uncertainty about the future of the current product line is the 3rd priority. Looking at new markets has the 4th priority. The ABC has a comfortable cash position and is very profitable. Cost reductions are not a key focus area. The only asset the ABC company has (apart from buildings, furniture, cars, IT equipment etc.) is the software. There are no plans of making the software or parts thereof available on an OEM or white labelling basis.

The management team now unanimously support the priorities.

The Customer Value Proposition

The ValuePerform consultant now asks the ABC management team to individually answer a set of questions, which will determine how they see the Customer Value Proposition of the company.

Click here to see the Customer Value Proposition questions. The Customer Value Proposition format is using the value elements approach.

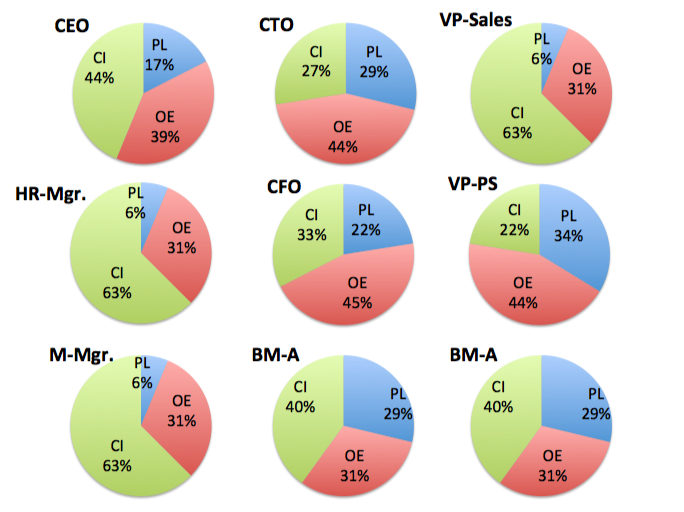

Answering the questionnaire generates a graphical representation of each individual managers perception of the ABC Company’s value proposition TODAY and in the FUTURE.

The outcome of the TODAY situation was:

The individual perceptions of the Customer Value Proposition TODAY

The individual perception of the Customer Value Proposition differs considerably in the management team of the ABC Company.

The VP of sales, the marketing manager and the HR manager, who all joined the company just recently, have the same perception. They see the Customer Intimacy value element as the dominating value element, Operational Excellence as the secondary and Product Leadership as the least important value element.

The CTO, the CFO and the VP of Professional services perceive Operational Excellence as the dominating value element.

The two members of the board of directors perceive Customer Intimacy most important, with almost equal emphasis on Operational Excellence and Product Leadership.

The ValuePerform consultant asks each of the team members to explain their motivation for answering the value proposition questions as they did. From the explanations, it clearly appears that there are more than semantic differences in the perception of the Customer Value Proposition TODAY. Looking at the different perceptions it is decided that the CEO, the CTO, the VP of sales, the marketing manager and a member of the board of directors shall have a separate meeting to review the differences and come to a common perception of the current situation.

Other posts in this series:

Post #1: Strategy? – oh no, not again!

Post #2: Introducing ValuePerform – a lean approach for strategy analysis and alignment

Post #3: The 6 sources for financial growth

Post #4: Why do management teams disagree?

Post #5: Getting the priorities in place

Post #7: The Customer Value Proposition TODAY

Post #8: The Customer Value Proposition in the FUTURE

Post #9: The Market Situation

Post #10: ValuePerform and the 15 Management Areas

Post #11: What is important and what is not?

Post #12: How are we performing?

Post #13: Identifying the important and the urgent issues

Post #14: The Action Plan

Post #15: Why does misalignment occur?

Post #16: The price of management misalignment

Post #17: Avoiding invisible or suppressed misalignment

Post#18: The cost/benefit ratio of ensuring alignment