Strategy for software Dummies – part 7

Strategy for software Dummies – part 7

The title for this series of posts is inspired by the extensive series of instructional/reference books, which serve as non-intimidating guides for readers new to the various topics covered, or for readers who need a solid brush up. The title doesn’t imply that software CEO’s are Dummies; only that there is a need for a new type of “strategy framework” that produces more than fluff and which can be completed in a very short time.

This post #7 explain how the ABC Company came to an agreement on their Customer Value Proposition TODAY.

A recap from post#6.

The ABC company is an Independent Software Vendor planning to go global. They have asked a ValuePerform consultant to help them put an international Go-To-Market plan together. The ValuePerform consultant wants to know the current position of the ABC company before any work on future strategies commences. It turns out that the management team wildly disagree on the priorities for financial performance. The consultant explains why the priorities must be set. After several internal meetings the management team come to a unanimous conclusion on how to prioritize the 6 sources of financial growth.

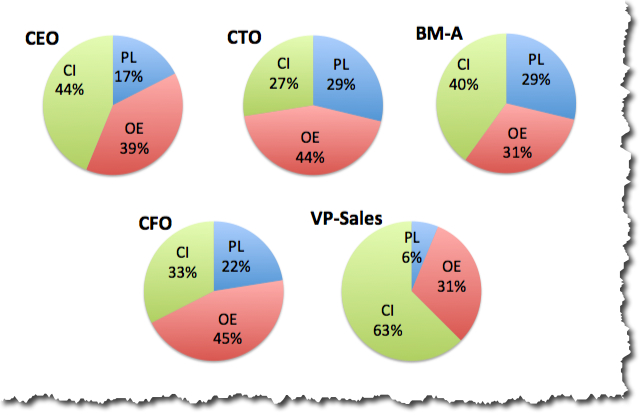

Each member of the ABC company management team is now given 15 questions. The answers will enable ValuePerform to illustrate how the individual member of the ABC management team perceived the Customer Value Proposition TODAY. It turns out that the ABC company management team does not agree on the Customer Value Proposition TODAY. The CEO, the CTO, the VP of sales, the marketing manager and a member of the board of directors, representing the various perceptions, are meeting separately to find common ground.

Customer Value Proposition

Most Independent Software Vendors do not have a documented Customer Value Proposition. Nor do they have a method for developing a (compelling) Customer Value Proposition. Obviously they, therefore, also miss a framework for verifying that all managers have the same perception of the Customer Value Proposition.

Is that a problem?

I would argue that it is the biggest obstacle to growth you can possibly have.

The lack of a compelling Customer Value Proposition AND the difference in the casual perception of how the company is providing value to its’ customers will cause managers and staff in any company to pull and push in different directions. If Newton’s laws of motion apply to human organizations, they net result of forces pulling in different directions is: SMALLER THAN THE SUM OF FORCES, ZERO or NEGATIVE.

Aligning the forces to pull and push a compelling Customer Value Proposition in the SAME direction will make a tremendous difference. You can most likely achieve much more top line growth with less resources yielding a higher profit at the same time. Improving customer satisfaction and employee satisfaction at the same time would be automatic by-products.

The ABC Company situation

The CEO, the CTO, the VP of sales, the marketing manager, a member of the board of directors and the ValuePerform consultant are meeting to find common ground. The first exercise is to review and fully understand the Value Element framework used to define the Customer Value Proposition.

From the nine different perceptions of the Customer Value Proposition found in the workshop, the current group agrees that 5 are representing genuinely different perceptions.

5 genuinely different perceptions

The most focused perception is provided by the VP of sales. His position is: “We win and retain our customers due to our understanding of the individual customer situation and our ability to customize our product to his specific requirements. We have people who have deep insight in the situation of the individual customer and we are responding fast to customer requests. Only seldom do we have to make product demonstrations or answer product related questions. I see our Value Proposition as dominated by Customer Intimacy, Operational Excellence is enabling us to provide our value at a reasonable price and the product itself plays a minor role.”

The other four Customer Value Perceptions are fairly unfocused.

CFO and CTO have Operational Excellence as the dominating value element. The CTO and the board member has the highest Product Leadership component.

The alignment process

The ValuePerform consultant takes the participants through the value element framework one more time and the group now start with a blank pie chart.

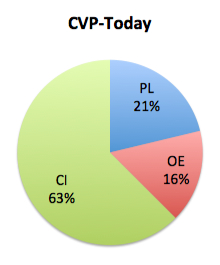

After some discussion the group agrees that Customer Intimacy is the most important element. They also agree that the cost of a solution is only a small fraction of the business value created, thus Operational Excellence is the least important value element. The main reason that the product is not a major focus for new customers is due to the company’s leading position in the domestic market. New customers take for granted that the product is OK, since everybody is using it. The group agree that the Customer Value Proposition looks as illustrated below.

Customer Value Proposition TODAY

The group agreed that the main reason for customers choosing and staying with the ABC Company is the ability to deliver customized solutions. The product is important, but as the product is well accepted in the market, new customers expect the product to fulfill the requirements. Because of the many installations in the domestic market the ABC Company has a well defined process for identifying and documenting customer requirements and for delivering on time, budget and quality. The excellent scoring on the annual customer satisfaction surveys confirms this perception.

Other posts in this series:

Post #1: Strategy? – oh no, not again!

Post #2: Introducing ValuePerform – a lean approach for strategy analysis and alignment

Post #3: The 6 sources for financial growth

Post #4: Why do management teams disagree?

Post #5: Getting the priorities in place

Post #6: The Customer Value Proposition

Post #8: The Customer Value Proposition in the FUTURE

Post #9: The Market Situation

Post #10: ValuePerform and the 15 Management Areas

Post #11: What is important and what is not?

Post #12: How are we performing?

Post #13: Identifying the important and the urgent issues

Post #14: The Action Plan

Post #15: Why does misalignment occur?

Post #16: The price of management misalignment

Post #17: Avoiding invisible or suppressed misalignment

Post#18: The cost/benefit ratio of ensuring alignment