And the Winners Remain China and India

TBK Consult has previously calculated the BECH Index annually based on data published by The Central Intelligence Agency (CIA). The current 2020 Corona report is based on data provided by the International Monetary Fund (IMF) and includes estimates for 2020 and 2021.

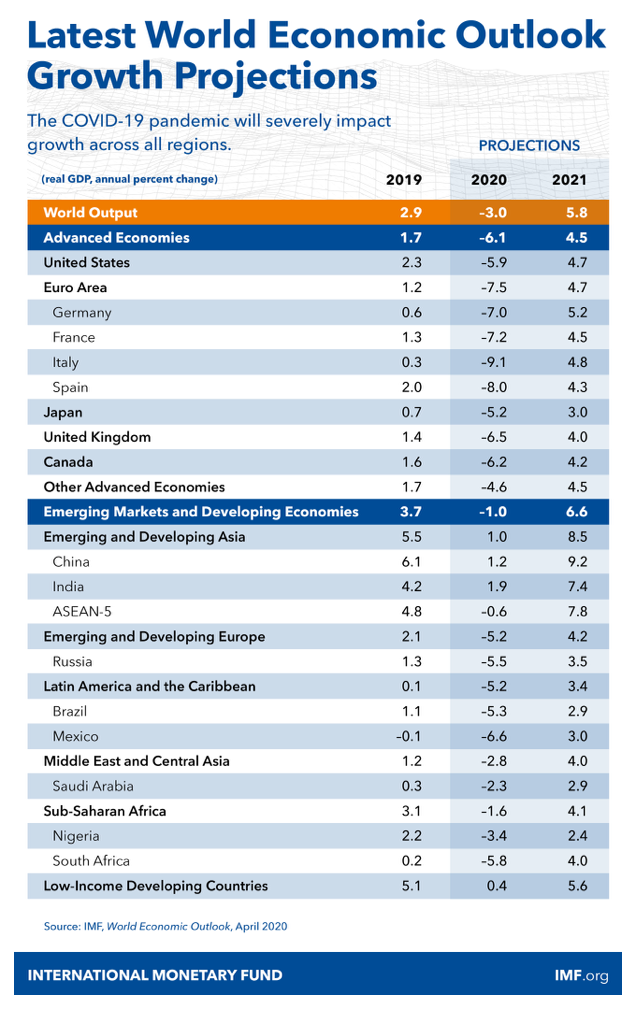

In April 2020 IMF published their first assessment of the impact on the global economy of the Covid-19 lockdowns across the world. They expected the recession to result in a three per cent contraction of the economy in 2020 followed by fast recovery with 5.8 per cent growth in 2021.

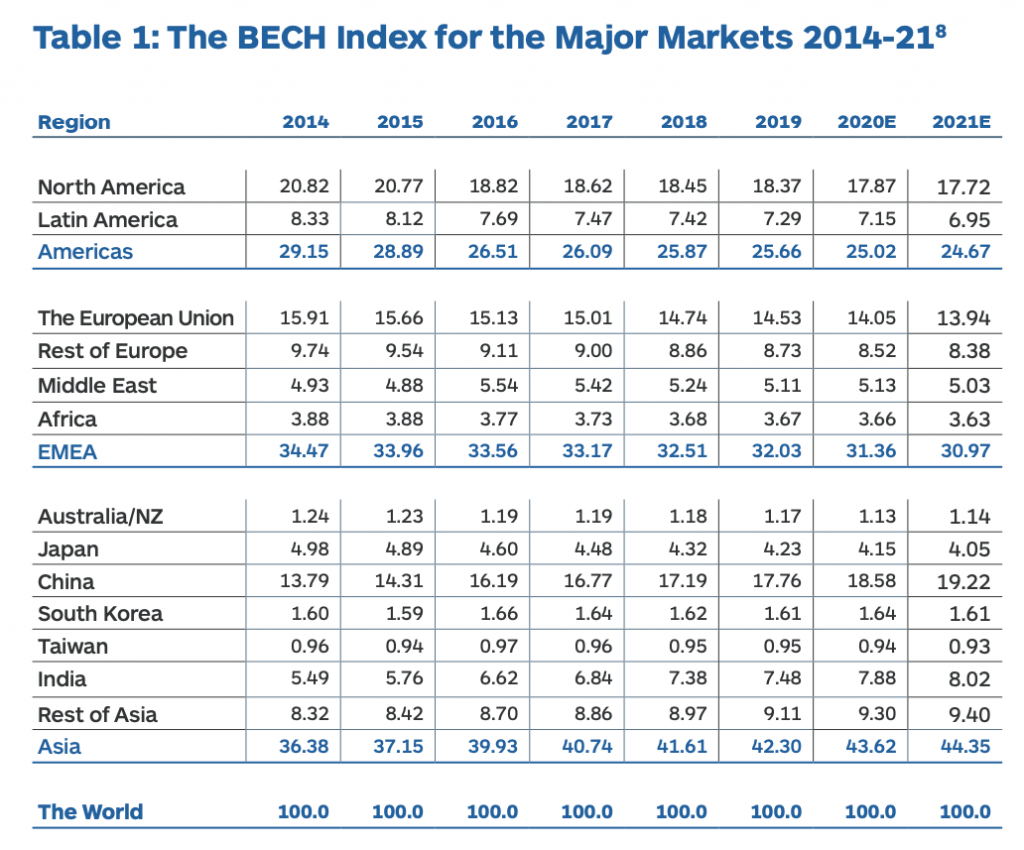

TBK Consult has simulated the distribution of global demand (the BECH index) based on the IMF data including the estimates for 2020 and 2021. It reconfirms the conclusion from our previous reports, only the trend has been accelerated. This means that China, India and what we call Rest of Asia (which excludes Australia, New Zealand, Japan, South Korea and Taiwan) are growing faster than any other countries.

IMF expects a busy 2021

The IMF expects a short but deep contraction on the global economy in 2020. However, as you look through the estimates for the various countries, you will notice an uneven spread. The bottom line is that the long-term trend predicted in my previous whitepapers have been accelerated.

Industrial demand is moving east, and the Corona crisis will leave China and India stronger than before.

“Because the economic fallout is acute in specific sectors, policymakers will need to implement substantial targeted fiscal, monetary, and financial market measures to support affected households and businesses domestically. Internationally, strong multilateral cooperation is essential to overcome the effects of the pandemic, including help for financially constrained countries facing twin health and funding shocks, and for channelling aid to countries with weak health care systems.”

Beyond the Corona crisis

The IMF data series for 2014 to 2021 includes 191 countries of which some of the bigger countries must be considered as several markets. Talking about the US as one market when you haven’t won the first customer or independent channel partner there yet may seem overly self-confident. For most information technology companies, the US is at least 50 geographical markets, Germany is 14 markets (Bundesländer), France is at least 4 markets, the UK is 4 markets, the Nordics are 4 markets and so on.

As can be seen from Table 1, world demand continues moving east. The Americas have experienced a 15 per cent decline in the period 2014-2021.

The demand from Central and South America drops again in 2021 and the decline in demand from North America results in a net loss of 1.39 per cent for the area.

The European Union (excluding the UK) has lost 12.4 per cent of global demand in the same period. Russia, the sixth biggest market, has lost 15.3 per cent since 2014.

North America and Europe continue to be very interesting areas with some of the biggest markets in the world and because of increasing labour costs and public expenditure there is a growing need for information analytics, process and cost optimisation information technology-based solutions.

According to the IMF data the Middle East’s share of global demand has been quite stable. Future growth in the Middle East still requires a restructuring away from the dependency on oil and gas and a general liberation of the economy. I remain sceptical that they will be successful with such a transformation and predict a decrease in the region.

Despite the Corona-crisis China is expected to continue its growth and gain a 3.46 per cent increase in its global market share from 2020 to 2021.

For 2021 the Asia Pacific region’s share of global demand increased 1.68 per cent. The most prominent growth area next to China is India showing a 45.9 per cent increase in the period 2014-2021.

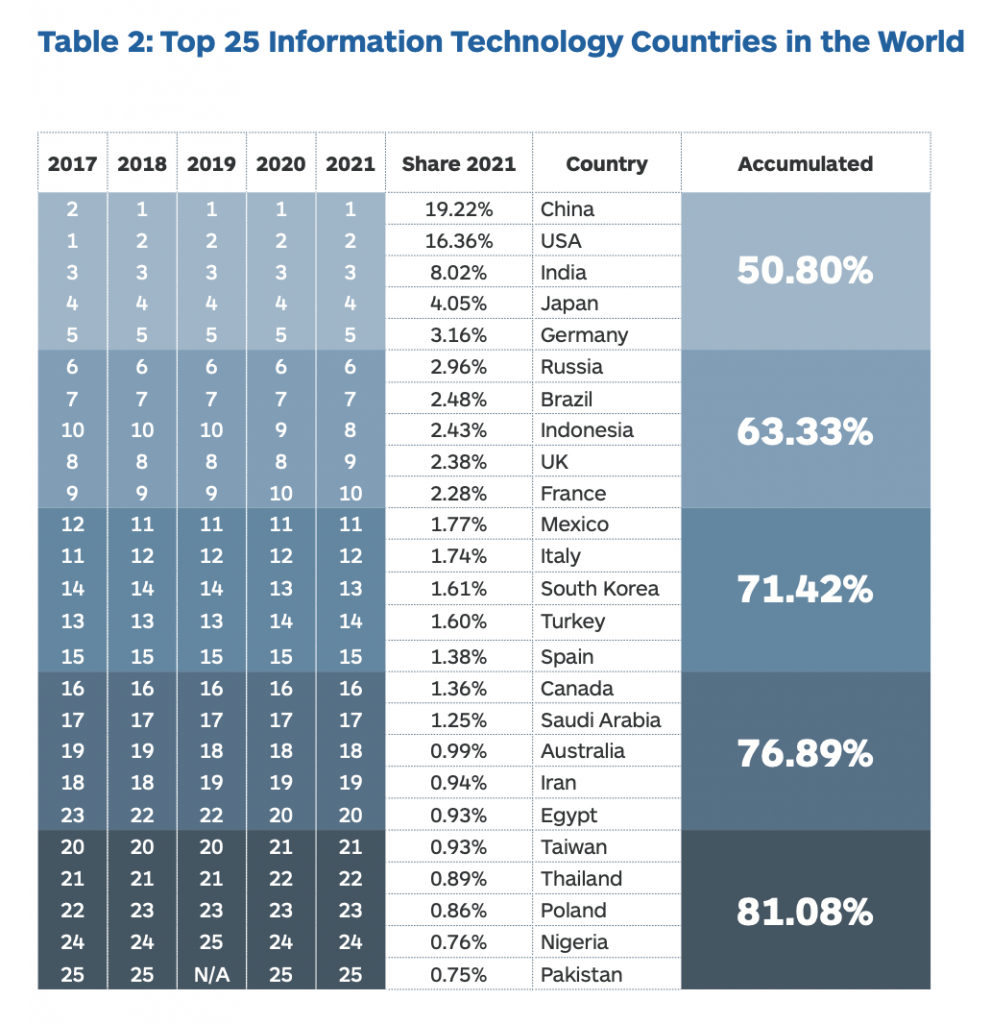

The Top 25 Markets

These 25 countries make up more than 80% of world demand for information technology products and services with 166 countries sharing the remaining 20%. This doesn’t mean that these 25 markets are the most attractive as issues other than size may play a more important role. The five countries USA, China, India, Japan and Germany make up over half of world demand for information technology.

Apart from Indonesia taking the position as the world’s number eight and the UK moving to place 9, no further changes are expected. None of the other countries have changed their position from 2020 to 2021.