Global growth through a partner channel in the software industry – Part 5: Partner Value Proposition (Bridgehead)

If you have enough money: Go direct. If you have enough time: Build a channel

In part 3 of this series of posts on the subject “Global growth through a partner channel in the software industry”, we presented the concept of the three stages of market penetration, which are:

1. Bootstrapping

2. Bridgehead

3. Leadership

In part 4 we discussed the Partner Value Proposition in the Bootstrapping stage of market penetration.

In this post we will discuss the Partner Value Proposition in the Bridgehead stage of market penetration.

The Bridgehead

The Bridgehead is the phase where the ISV is establishing his [slider title=”own representation.”] We know from experience that very few ISV’s recognize the need for their own representation, when they are in the initial phase of bootstrapping. We must emphasize that achieving a leading market position requires a local representation.[/slider]

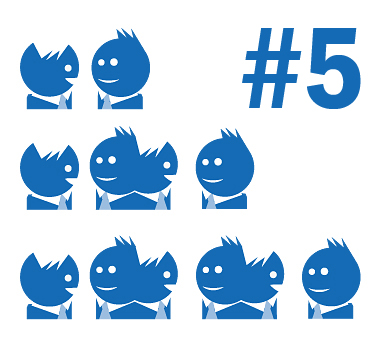

The objective of the bridgehead stage is to grow from the first 5-10 lighthouse customers to full geographic market coverage.

The characteristics of the initial Bridgehead stage are:

- You have established a pool of lighthouse [slider title=”reference customers.”] You and your solution have proven valuable to local customers. Your Customer Value Proposition has been endorsed by local customers.[/slider]

- You have partners who have been through the entire learning curve and [slider title=”value chain”] You, your solution and your Partner Program have proven valuable to partners. Your Partner Value Proposition has been endorsed by local partners.[/slider]

- You have a revenue stream to support further investments in market penetration

- You know the key consultants, analysts and press people and they are now prepared to listen to you

- You have experience with the competitive situation in the local market

- You have experience with local market idiosyncrasies

Partner Value Proposition (Bridgehead)

Bootstrapping

potential partners and customers are reluctant to deal with a new player who cannot demonstrate local proof-of-concept/proof-of-value with other partners/customers. You will have to refer to success stories in other countries, and we all know that potential partners and customers are skeptical of anything outside their own geography.

potential partners and customers are reluctant to deal with a new player who cannot demonstrate local proof-of-concept/proof-of-value with other partners/customers. You will have to refer to success stories in other countries, and we all know that potential partners and customers are skeptical of anything outside their own geography.Bridgehead

idiosyncrasies. You can now answer most of the questions posed by potential partners and customers based on factual local insight.

idiosyncrasies. You can now answer most of the questions posed by potential partners and customers based on factual local insight.Lead generation

Establishing the Bridgehead

The Bridgehead is your representation in a local geography. The objective of the bridgehead is to secure full geographic coverage in the territory. It is very unlikely that you can achieve full market coverage without a local [slider title=”representation.”] For certain very niche oriented products, a local bridgehead may be required in markets of a certain size only. Example: Imagine a solution for weather agencies. There may be only one or two weather agencies in a small country and there is no basis for a local representation and your customers will not expect this either.[/slider] Thus you need a bridgehead.

As a rule of thumb you start building your bridgehead when you have a revenue stream and pipeline that can cover the cost and secure breakeven within 18-24 months.

The role of the Bridgehead

The Bridgehead is responsible for growing the channel, supporting the channel, local branding and local lead generation.

Bridgehead format

The main issues underlying the decision for the bridgehead format are control, drive and exit option. Unfortunately they do not correspond very well with each other.

| Issue | Comments |

|---|---|

Control |

You do not want a bridgehead that you cannot control. You want to have the power to hire and fire the country manager. You want to set and drive the direction of the business. |

Drive |

Your bridgehead is by definition remote. How do you motivate the staff in the bridgehead to go out of their way and grow your business? When people get on the pay-roll with high fixed salaries, they tend to be comfortable and relaxed. The list of well paid country managers who failed to deliver the results, misused the funds and left a mess behind is unfortunately very long. |

Exit |

If you do not own or have a pull option on your bridgehead, what are you going to do in an IPO or industrial/financial exit situation? The revenue recognition portion of a bridgehead you do not own is small and limited to the margin you receive. |

The joint venture/acquisition model

Acquiring or doing a joint venture with a local player is a proven way of making a bridgehead. You should insist on having full control, but leave enough equity to the joint venture partner to motivate an extraordinary effort until critical mass has been achieved. In some geographies the joint venture model is for legal and/or traditional reasons the only possible way to get a local representation.

The fully owned subsidiary

The fully owned subsidiary is the preferred way for most ISV’s. Placing one of the ISV’s senior executives to run the bridgehead until critical mass has been achieved is also a well-known approach. Your main challenge is managing the subsidiary. Setting up a subsidiary requires substantial investments. Running subsidiaries requires a corresponding headquarter function. Subsidiaries do not manage themselves.

The “master franchise”/distributor

The “master franchise”/distributor model may be tempting and may also work if you have a pull option. 100% dedication to the business is crucial.

Examples of Bridgehead formats

The Navision model

Navision was an ISV in the ERP market. Their international go-to-market model was through a master franchise type concept, where the local distributor operation was owned and operated by independent parties. The distribution agreement included a pull option for Navision. At any time (after a grace period) Navision could exercise a partial or full purchase of all shares in the distribution company. The pull price was defined through an algorithm agreed to by both parties from the beginning. Before Navision filed their IPO they rolled up the entire network, exercising their pull options. Navision later merged with Damgaard and was acquired by Microsoft in 2002.

Navision was an ISV in the ERP market. Their international go-to-market model was through a master franchise type concept, where the local distributor operation was owned and operated by independent parties. The distribution agreement included a pull option for Navision. At any time (after a grace period) Navision could exercise a partial or full purchase of all shares in the distribution company. The pull price was defined through an algorithm agreed to by both parties from the beginning. Before Navision filed their IPO they rolled up the entire network, exercising their pull options. Navision later merged with Damgaard and was acquired by Microsoft in 2002.

The owners of the local master franchises had the full P&L responsibility. They knew that there was an exit strategy and equity earn out opportunity.

The drive and commitment you get, when people are responsible for their own business operation and can read the equity value in their dispositions, is hard to match with staff on fixed salary and a commission plan.

Exercising the pull option was a major investment for Navision. However it was financed by the IPO and was a balance sheet maneuver.

The Navision model still stands as one of the most successful internationalization models in the software industry.

The Damgaard model

Damgaard was also an ISV in the ERP market. Their international go-to-market model was based on a strategic alliance with IBM. IBM was responsible for setting up and managing the partner channel worldwide.

Damgaard was also an ISV in the ERP market. Their international go-to-market model was based on a strategic alliance with IBM. IBM was responsible for setting up and managing the partner channel worldwide.

While IBM certainly was an excellent brand name for attracting new local partners in the bootstrapping phase, it was not a good model for generating and sustaining growth. Damgaard eventually bought back the distributions rights from IBM and established its own subsidiaries to manage and grow the channel internationally.

Setting up subsidiaries simultaneously in several countries is a costly affair, which has a major impact on the P&L. On the other hand, it is highly controllable. Damgaard made a roll out of Axapta (now Microsoft Dynamics AX) through its subsidiaries in a highly uniform way over a very short time. To secure control, Damgaard stationed senior executives in the country management positions until critical mass was achieved.

The IBM agreement, which looked perfect on paper, probably resulted in a 5-year delay for Damgaard. Dealing with IBM was also a drain on the management resources for Damgaard.

Damgaard made a successful IPO in 1999, merged with Navision in 2000 and was acquired by Microsoft in 2002.

Bridgehead before bootstrapping

There are situations where it makes sense or where a bridgehead is even required before you can commence bootstrapping:

- When your value proposition is “me too”

- When you can afford it

“me too” value proposition

When your value proposition and the way you position yourself is very close to already established players in the market, then your only way to penetrate a new market is through brutal force. It is the application of an ancient military strategy – the army with the most soldiers will win the battle. You cannot execute the brutal force strategy from the outside; you must have a bridgehead first. Your bridgehead may be combined with a local acquisition.

You can afford it

It is not unusual to set up a bridgehead before bootstrapping. If you can afford the investment and if you can accept the unpredictability of time-to-revenue, then it is recommended to start with a bridgehead.

Final remarks on the bridgehead

Establishing a Bridgehead may not be at the forefront for the ISV standing in front of the bootstrapping phase. It should be. If you do not intend to get to the bridgehead, then bootstrapping makes no sense. Why go through all the hassle of bootstrapping and then leave it there? You may have a profitable business for a couple of years, but then you will be outcompeted. No ISV we can recall has survived without moving to the bridgehead.

The virtual representation

Many ISVs establish a virtual representation with an address, a telephone number and an agent/consultant on a part time basis. The virtual representation is supposed to be perceived by the market as a real representation.

Many ISVs establish a virtual representation with an address, a telephone number and an agent/consultant on a part time basis. The virtual representation is supposed to be perceived by the market as a real representation.About this series of blog posts on “Global growth through a partner channel in the software industry”

An associate of mine once concluded: If you have enough money: Go direct. If you have enough time: Build a channel.

My associate had been spearheading the development of one of the most successful VAR channels in the world. This channel now belongs to Microsoft and is branded Dynamics.

This series of posts will discuss the issues associated with using a channel based Go-To-Market approach on the path to global market leadership for Independent Software Vendors.

Few success stories and numerous failures

Using a channel of independent companies to resell, implement and/or service customers has a long tradition in the history of the software industry. For some software companies, the channel has been a major contributor to global success, but for most software companies making it work is a depressing and constant struggle.

The word “channel” is used in the software industry to describe independent companies that assume various roles and obligations in bringing a software product to the customers. The definition is rather broad, since the roles and obligations can vary substantially from “simple” reselling to system integration, solution development on top of the software, implementation in terms of consulting, project management, customization, training and support.

The common denominator is the fundamental condition that the individual channel operator is an independent contractor operating in his own name, at his own expense and at his own risk.

Other post in this series

Post #1: For all the wrong reasons

Post #2: For all the right reasons

Post #3: The three stages of market penetration

Post #4: The Partner Value Proposition (Bootstrapping)

Post #6: The Partner Value Proposition (Leadership)