Money is Not the Problem in the German Software Industry

A recent study in Germany concluded that there is no significant relationship between growth in the software industry and the availability of external funding.

The study is a part of the research project “German Software Champions,” which is a scientific cooperation between the German Federal Ministry of Education and Research (BMBF), the Institute for Information, Organization and Management (IOM), the Institute for Computer Science and New Media (WIM) and the Center for Digital Technology and Management (CDTM).

We wrote a summary of the conclusions from the “German Software Champions” research project presented at the “Parlamentarischen Abend” in Berlin, June 5th this year.

Germany is the second largest software market in the world. $79,4B was spent on software and related services in Germany in 2012.

In spite of this huge domestic market, Germany doesn’t foster many global software brands.

Out of the 250 biggest ICT companies in the world, only 6 are from Germany. Out of the top 50 biggest Internet companies in the world, only 4 are from Germany.

Germany represents 5,67% of world demand for software and software related services. While this is a very lucrative domestic market for the local German software vendors it is not enough for growing to a size that can withstand global competition. 94,33% of the global market for software and software related services remains OUTSIDE Germany!

Money is not the problem in Germany

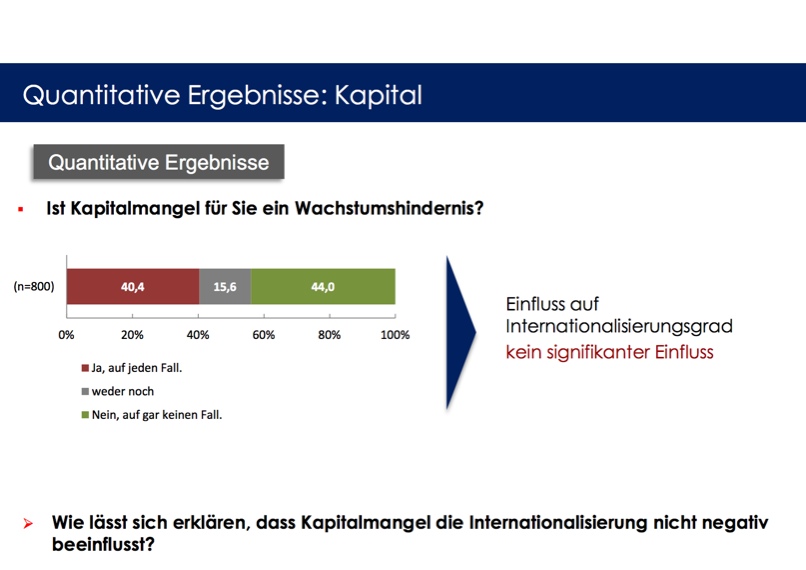

Out of 800 software companies asked, 44% claimed that the availability of external funding was NOT inhibiting growth. 15,6% didn’t have an opinion and 40,4% did find that lack of funding was a growth inhibitor.

The research team concluded that the availability of external funding had no significant influence on the lack of international growth demonstrated by the German software industry.

Common sense and business “science” assumes that there must be a relationship between the availability of funding and growth. The research team therefore asked the simple question: What are the reasons for this missing relationship.

They come up with three answers for the German software industry:

- German software companies choose to follow niche strategies where market leadership can be achieved organically without external funding.

- German software companies are more patient taking the time required to grow organically to leadership positions.

- German software executives do not have a personal network including Venture capitalists, business angels and other type of external accelerators. Thus they simply do not have access to the external funding ecosystem.

The research team compares the German software industry ecosystem with the Silicon Valley ecosystem. The conclusion is that the availability of venture funding, personal networks and acquisition [slider title=”acquisition”] Big global companies grows both organically and through acquisitions. Global market leadership requires consolidators and most of the global consolidators have their headquarters in the USA. [/slider] giants provides substantial advantages to the US software industry.

Theory and praxis

Common logic will say that the more we can invest the faster we will grow.

Grow what?

Eyeballs? Awareness? Likes? Users? Subsidiaries? Order backlog? Revenue? Profit? Equity?

Let me give you a tragic example of an external funding disaster.

When money becomes the problem

A clever fellow once developed a piece of software, which could solve genuine business problems for a lot of small companies. The software could improve the customers’ customer service, reduce the operational cost, improve revenue, improve cash flow, reduce inventory and reduce bad debt. The software could demonstrate RoI in less than 90 days.

The clever fellow had developed the software using and combining software development tools and platforms from one of the huge software vendors. The huge software vendor really wanted to push all the other software developers in the same direction as they saw a tremendous market potential in this area. The huge software company therefore appointed the clever fellow to “Partner of the Year” and the award was presented at a big conference in the presence of thousands of people.

The clever fellow had developed the software using and combining software development tools and platforms from one of the huge software vendors. The huge software vendor really wanted to push all the other software developers in the same direction as they saw a tremendous market potential in this area. The huge software company therefore appointed the clever fellow to “Partner of the Year” and the award was presented at a big conference in the presence of thousands of people.

The press was also there and in the next weeks the clever fellow was on the front page of all the business newspapers.

Now the clever fellow’s phone started ringing. None of the calls came from potential customers. All the calls were from people who wanted to sell him something. Consulting, recruitment, marketing services, partnerships and MONEY. Yes, the venture community had seen the opportunity and wanted to sell the clever fellow money against shares in his company.

The clever fellow took the money in exchange for shares and seats at the board of directors.

And now the trouble started.

The venture folks wanted growth. They wanted global expansion before someone else closed the window of opportunity.

The clever fellow hired more people, jumped on partnership (reseller) opportunities, engaged external consultants helping him with public relations and marketing. The money flowed (out) and he was busy as never before. But one day the money was gone and now operating expenses by far exceeded revenue. More money was needed.

No problem said the venture people, but this time the terms are different.

The clever fellow had no choice. He had to accept the new terms, the dilution and an operational straitjacket that made his life miserable.

The new money didn’t do the trick either. Eventually the equity had to be restructured, the company resized and finally the company was acquired for a very small price.

The fun element

Starting and running a business should be fun. You are spending most of your waking hours getting the venture airborne and onto a comfortable altitude where you can cruise on lower fuel consumption (and auto pilot?).

Consider carefully if you will exchange control (freedom) for money!!

Consider carefully if you will exchange control (freedom) for money!!

If you believe that could be an option don’t do it when you NEED the money. Never negotiate with your back against the wall. Then look at the people behind the money. How can they contribute? Are they just bankers or do they have personal operational experience with growing companies. Have they ever failed? Be careful with people who (claim they) never failed. Failing is such an important learning experience.

Funding and growth: The conclusion

I think we should stop spending so much energy on external funding in the software industry.

First of all the probability of getting funding for untested business models are worse than winning the lotto. Some people do win the lotto and some people do get seed funding, but stop talking about it. We are living in a global world. The software industry is more global than any other other industry. Globalizing a software business is much easier than any other business requiring tons of physical assets and logistic infrastructures.

If you have a great idea that can scale like crazy within a very short time you should go where the funding is. Then learn and play by their rules. It’s their money and they get thousands of ideas thrown at them all the time. You need to play on their terms and stop whining in the press.

Most businesses are much better off bootstrapping organically, prove that their business model works and then take funding if the cake can grow bigger and faster this way and they are prepared to give up control.

Growing global software companies takes ambition, creativity, hard work and patience.

External funding cannot compensate for any of these virtues.

Other posts on this subject:

Why are German software companies failing to get global markets shares?

The German Software Industry Dilemma

Getting Qualified People is not the Issue in the German Software Industry

An Insular Mindset is the Issue in the German Software Industry

Lack of International Network is a Problem in the German Software Industry

BREAKING NEWS: Technology Clusters have no relevance in the German software industry