International Bootstrapping and The Power Distance

All software driven companies with ambitions for global growth face the same challenge:

Where do you start?

Should you take the UK before Germany? Is Brazil an attractive market? What about India, Russia and China? When do you take on North America?

As you know very little about each market how do you decide where to start?

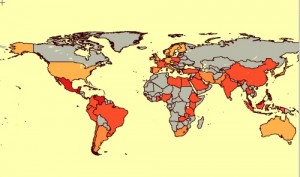

Apart from the distance to the market and the investments it requires in translation and localization Hofstede’s Power Distance Index may be a good indicator for where to start.

Geert Hofstede

Hofstede’s Power Distance Index measures the extent to which the less powerful members of organizations and institutions (like the family) accept and expect that power is distributed unequally. The fundamental issue here is how a society handles inequalities among people. People in societies exhibiting a large degree of power distance accept a hierarchical order in which everybody has a place and which needs no further justification. In societies with low power distance, people strive to equalise the distribution of power and demand justification for inequalities of power.

My claim is that it is easier (faster) to bootstrap B2B markets with low power distance. Countries with low power distance have a higher degree of delegation. This means that staff on all levels in an organization are empowered to take bigger decisions than is the case in countries with higher power distance.

In countries with low power distance there is an emphasis on WHAT you know. In countries with a high power distance there is an emphasis on WHO you know.

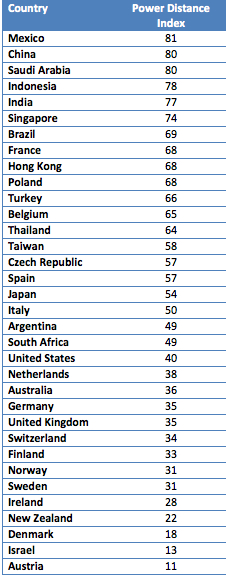

Power Distance Index for selected countries

As you can see in the table the countries with the lowest power distances are all small markets. What is also interesting for the small markets are their preparedness to do business in a foreign language. All the small markets with low power distance are prepared to communicate in English. This is not the case as you move into bigger markets with higher power distance.

If my claim is correct then it will be three times faster to bootstrap in Austria than in Germany. Twice as fast to bootstrap in Denmark than the in UK. Twice as fast to bootstrap The Netherlands than Brazil. Two and a half time faster to bootstrap Norway that China.

Translate these differences into years: What you can accomplish in Austria in one year takes three years in Germany. What you can accomplish in one year in Denmark takes two years in the UK. What you can accomplish in one year in Norway takes two and half years in China.

Market Size

The size of a market is one of the key considerations companies are making before deciding where to go first/next. The logic seems to lead companies to go for the largest markets first. Most companies forget to take their own available resources into the equation.

The critical path and the bottleneck to global bootstrapping is NOT the size of the individual markets, but entirely a function of the resources you have available.

Germany and the UK are the largest markets in Europe. BUT bootstrapping into these markets also requires substantial resources and takes time. Bootstrapping into the smaller markets first and achieve faster RoI may be a much better strategy. By taking the smaller and easier markets first companies can grow their marketing “muscle” and take on the larger markets with more impact later. At the same time companies can test and refine the replicability and scalability of their business models before moving into the bigger markets.

Competition

There are obviously other issues determining the attractiveness of a market. The competitive situation is one of the more important factors. Unless you have invented a disruptive technology or business model, there will always be local competitors. But again: they tend to be smaller in small countries and bigger in large countries. However, the competitive situation is always worth checking out before you invest in a new market. If migration costs are high customers may prefer to stay with current suppliers even if your value proposition is very attractive.

BRIC

Brazil, Russia, India and China.

Over the last couple of years there has been a lot of fuzz around the opportunities in these four growth markets. In my own country (Denmark) government has urged business to invest in those four markets. While this may be good advice for companies with proven business models and solid bank accounts it can be deadly for small companies. In a B2B context the BRIC countries are small, complicated and far away.

If you are a small software driven company and have your international growth ahead of you then start with the small uncomplicated markets first. Choose the best combination of physical distance and power distance and take the markets in this sequence.

Source for information on the size of each country in world: The BECH Index