Steps to designing and executing productive Partner Channel Programs in the software industry

This post discusses how a productive [slider title=” channel “] the post deals exclusively with the one-tier channel setup[/slider] program in the software industry should be designed and executed.

This post discusses how a productive [slider title=” channel “] the post deals exclusively with the one-tier channel setup[/slider] program in the software industry should be designed and executed.

Using a channel of independent companies to resell, implement and/or service customers has a long tradition in the history of the software industry. For some software companies, the channel has been a major contributor to global success, but for most software companies making it work is a depressing and constant struggle.

The three stages of market growth

All software companies must grow through three main stages to achieve local and global leadership in a certain market:

Working with channel partners on the journey to local and global market leadership requires completely different approaches (and people) in each of the three phases.

Bootstrapping

When you first start working with partners you are typically in one of the following three situations:

- You have no installed base. You want a channel to assume responsibility for sales, marketing, implementation and customer management. You are a “startup”.

- You have an installed base of customers in your domestic market that you have built and also manage yourself. You now want to build a channel to generate growth outside your domestic territory. We will call you “The Channel Shifter” as you are moving from a direct sales to an indirect sales-based business model.

- You already have a channel of partners assuming responsibility for sales, marketing, implementation and customer management in your domestic market (or some other portions of the value chain). You now want to extend the channel to generate growth outside your domestic territory. We will call you “The Channel Extender” as you are already selling through a channel and “just” want to extend this channel into other territories.

This post does not discuss the issues related to product localization. We assume and recommend that you have sorted out these issues before commencing massive market penetration.

A: The startup

Stop reading this article if you are a startup. Go to Steve Blank’s blog. Buy his book: “The Startup Owners Manual“. Come back to this article in 6-24 months.

B: The Channel Shifter

The good news is that you have an installed base of customers. You have a business model that works and can be [slider title=”replicated”] if not, then you are still in startup mode. Go back to “The Startup” [/slider]. You know exactly what to look for when extending your sales and implementation capacity. You are most likely approaching or just past [slider title=”the tipping point”] the tipping point is around the 20% market share mark where market dynamics start working in your favor reducing cost of sales and reducing sales cycles [/slider] in your current market(s).

The bad news is that your peoples’ experience and skill-set and your organizational processes are not designed or geared towards building and serving a channel. The bad news is probably also that your product is not designed with a partner channel in mind either.

Changing from direct to indirect sales requires that you change your business model and maybe even your product.

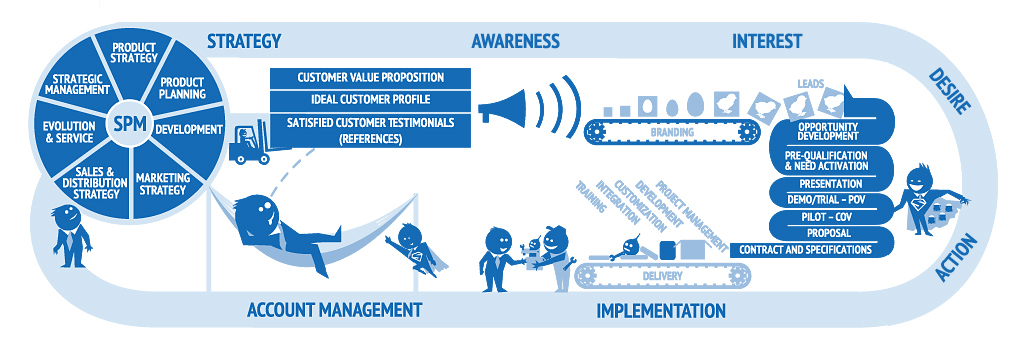

The value chain

Your first decision is to define which parts of the value chain you want your partners to be responsible for.

Keep in mind that a channel does not perform the following activities very well:

- Branding

- Awareness building

- Lead generation

- Market bootstrapping

Unfortunately these activities are exactly what you need when entering a new market. Your only option is to work very closely with your new partners and heavily support the initial lead generation and market bootstrapping activities.

The Channel Shifter Partner Program

As you have no track record or “proof-of-concept” with partners, you must design a partner program that compensate the partners for the uncertainties. The Partner Program should focus on the activities related to find, win and keep happy customers – fast.

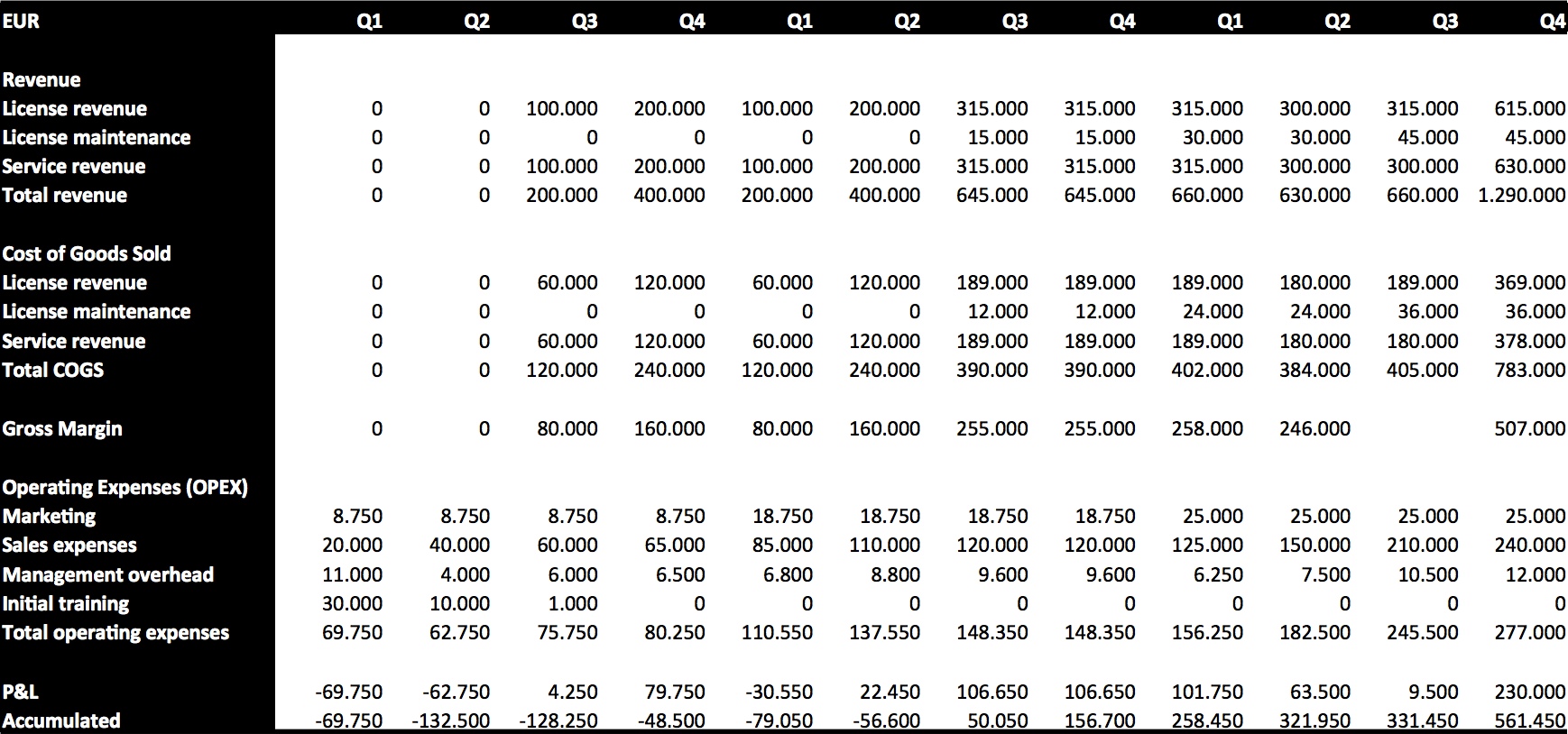

Apart from having the usual concepts defined and documented (customer value proposition, ideal market profile, product strategy roadmap, pricing and sales and marketing collateral) your Partner Program should be designed around your Partner Value Proposition and especially the Partner P&L model.

[slider title=”Note”] A software company with a direct business model will be used to taking all the revenue and all the profit in the above P&L. With a partner channel in between it will make only 32% of the revenue it is used to [/slider]The Partner P&L reflects the financial impact of your bootstrapping concept:

- How is the Partner going to win his first customers?

- What are the investments required?

- How long is “time to first revenue”?

- How long is “time-to-profit”?

- What does the long-term perspective look like?

- How do you contribute?

All elements of your Partner Program should have fast partner profitability as the focal point. We are not recommending that you play “Santa Claus”, but you must realize that in the bootstrapping phase you need the partners much more than they need you. You can only ask a partner for commitments and investments if you are prepared to reciprocate.

Offering a high margin on the first deals has absolute no impact on either “time-to-revenue” or “time-to-profit”. Channel partners are Teflon coated by software companies offering high margins and showing no willingness to share workload risk.

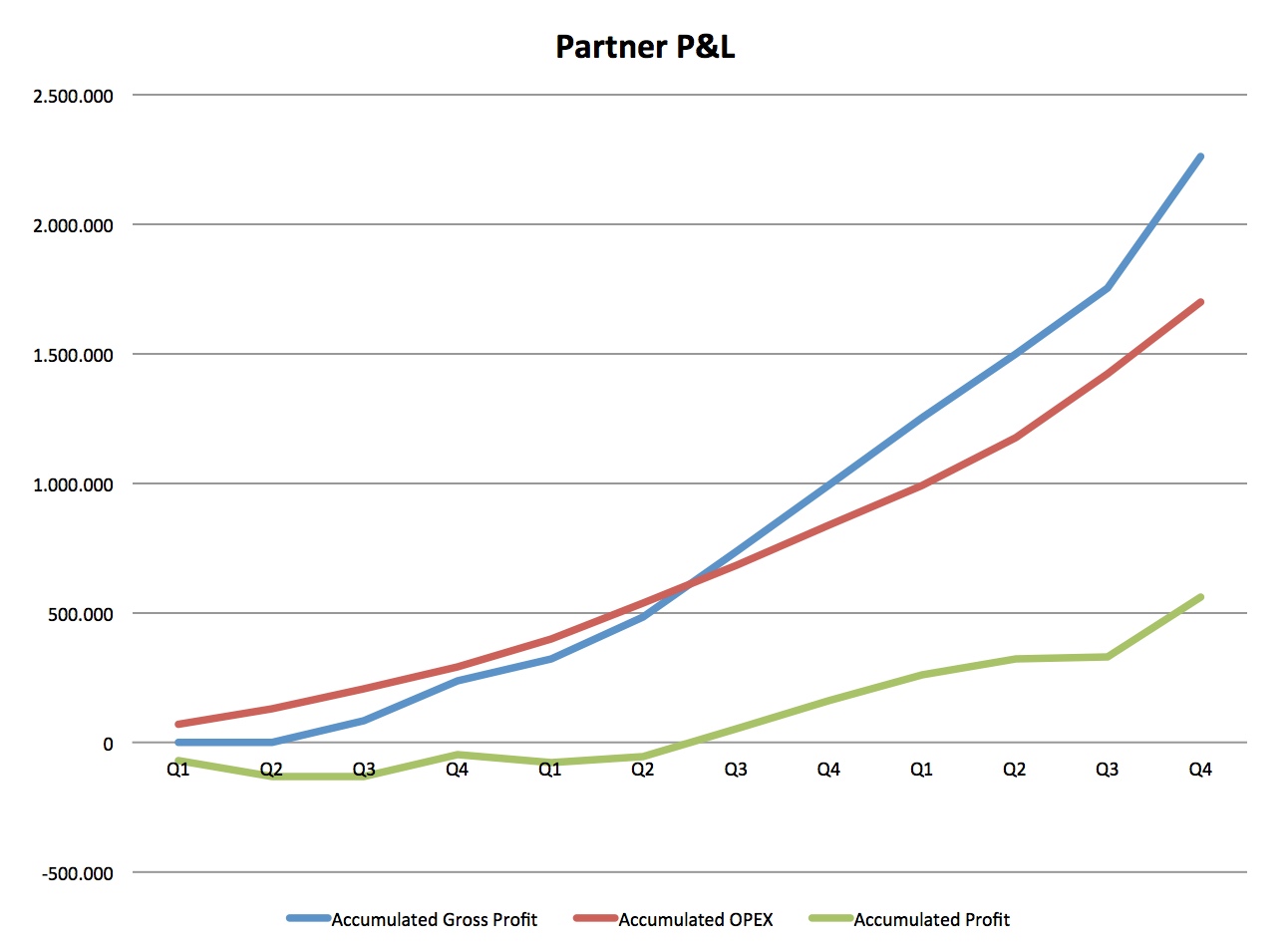

In the example above the Partner P&L shows a very profitable business opportunity. For the first 36 month the profit/revenue ratio is 10% and the performance in the 12th quarter is 18%. The RoI for the three-year period is over 300%. However, time to first revenue is 8 months and time to profit is 19 months. The total cash requirement for the partner starting a business with your product is €160.000. Do you believe this Partner P&L is attractive? Do the potential partners you have identified have the financial muscle to invest €160.000?

What happens if time to revenue shows to be 10 or 12 months? What happens if time to profit is 24 months? What happens if the cash requirement turns out to be €200.000 or €250.000?

You must be prepared to review these investment scenarios with your potential partners and be honest and realistic about what it takes to get started. Your disadvantage is that you have no experience with the partner channel, nor do you have any working partners who are showcases for your Partner Value Proposition. Building the partner channel is a learning experience and you must be prepared to adjust as you move along, including participating in some of the market penetration investments that your first partners’ face.

The Channel Extender Partner Program

The Channel Extender has substantial experience with recruiting and bootstrapping partners. He will have all the programs in place for a new territory except the competitive map.

Moving into a new territory will provide new competitors. Many software companies ignore local competition and deal with it when things don’t progress as planned or expected. That is not recommended. Potential partners in a new territory will assume that you have familiarized yourself with the competitive situation and that you have a strategy for dealing with it.

Exclusivity?

For the more than 30 years I have been working with channel development in the software industry the exclusivity issue continues to pop up in each and every bootstrapping situation – and for good reasons.

For the more than 30 years I have been working with channel development in the software industry the exclusivity issue continues to pop up in each and every bootstrapping situation – and for good reasons.

Take the example above. A channel partner is going to invest €160-250K in building a business with your product. He wants to protect that investment. If you don’t address this issue, he will. Exclusivity is the first thing he will ask for.

If you expect the partner to invest in branding, awareness building and lead generation he would be downright stupid not to ask for some sort of protection from negative [slider title=”externalities”] Externalities are the opportunities the partner’s activities will generate for other partners that you appoint. Other partners will get a “free ride” at the first partners’ expense[/slider].

Exclusivity is a “no-go,” but you must address the “externality” issues your new partners will face in the bootstrapping phase. As soon as you are well into bridgeheads the issue will stop popping up in a generic context.

Bridgeheads

Let us be very precise on this issue:

You will never achieve any significant market position anywhere unless you are present in the market. Yes, there are a few exceptions, but 99% of software companies need local representation if they want to achieve any notable market position in a market.

The question is if you need the bridgehead before you can start bootstrapping?

Big Market Egos

We think it is fair to state that bootstrapping big markets from the outside is very difficult if not close to impossible. Partners in big markets will expect you to drive branding, awareness and lead generation. They will also expect you to provide local support. Big markets also have bigger language issues.

Small Market Egos

Potential partners in small markets do not expect you to invest in a bridgehead. You may start in smaller market [slider title=”first”] Norway, Poland, Sweden, Finland, Denmark, Austria, Ireland, Turkey etc. are excellent places to start [/slider] before moving into the big markets. Testing your Partner Value Proposition and your Partner Program in a small market first may be an excellent way to learn what works and what doesn’t.

Setting up the bridgehead is costly and risky. We will deal with risk mitigation initiatives related to building bridgeheads in later posts.

In the Bridgehead phase your Partner Program is affected by your growing installed base and the number of partners who are successfully running a business based on your product.

“Proof-of-concept” will enable you to tighten requirements and decrease the level of investment you make in the individual partnership. Don’t move too fast. You still need to extend your coverage into new areas of the new market.

The partner convention

The one thing that you should do as soon as you have a fair amount of partners is organize your first “Partner Convention”. Bringing the partners together for 2-3 days around a program of professional and social activities will have a tremendous impact on partner motivation and engagement. Creating the “we are a crowd!” feeling is extremely stimulating for your partners and your own self-perception. It is also an excellent opportunity for you to get feedback from several partners at the same time and provide the partners a platform for working together.

The one thing that you should do as soon as you have a fair amount of partners is organize your first “Partner Convention”. Bringing the partners together for 2-3 days around a program of professional and social activities will have a tremendous impact on partner motivation and engagement. Creating the “we are a crowd!” feeling is extremely stimulating for your partners and your own self-perception. It is also an excellent opportunity for you to get feedback from several partners at the same time and provide the partners a platform for working together.

Combine the Partner Convention with important executive activities, awards and announcements to ensure that it is the Partners’ top management that participate. Later on you can extend the program to address other partner staff functions or establish separate conferences for the various job roles.

Recruit, then qualify

While recruiting the “right” partners in bootstrapping is crucial, you can be less restrictive as you expand for coverage. In bootstrapping, negative customer experience will reflect back on you. As your grow the channel this issue will be less critical. Customers now have a choice of partners and bad experience will be perceived as a partner related issue rather than a product related issue.

The strategy in the bridgehead should be “recruit like crazy and qualify later based on who makes it and who doesn’t.”

The tipping point

Building bridgeheads and expanding geographic coverage is an ongoing effort until you reach the 20% market share or “the tipping point” in any given market. Beyond the tipping point market dynamics change and demand accelerates on its own. You (and your partners) will experience decreasing cost of sales and shorter sales cycles.

Now is the time to scale for dominance.

Scale for dominance

In the scaling for dominance phase your partner program will change as follows:

- You introduce certification programs for individuals

- You divide your partners into three groups: A, B and C

- You introduce a more precise and narrow definition of available market segments

- You further formalize ecosystem platforms and encourage ISV actitivites

Certification

We all know that the lion’s share of experience, skills and competencies reside with individuals and not with organizations. You therefore make your partner recruitment and classification dependent on the number and types of certified people they employ. A comprehensive certification program will attract individuals who are eager to increase their market value and it will communicate quality and professionalism to the market.

Partner ranking

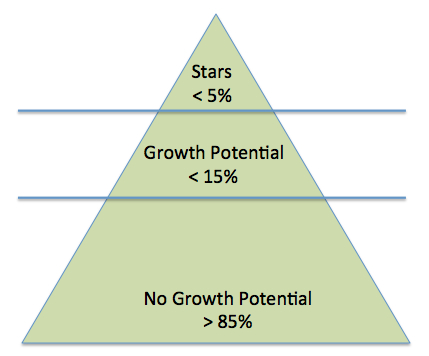

As you recruit more and more partners you will learn that they fall into three groups:

A – Partners who are capable of running and growing a professional business on their own and also do so (<5%)

B – Partners who – with some assistance – can grow their business (5-15%)

C – Partner who will never be able to grow their business (85%)

We have assigned the approximate share of your partners in brackets.

Your official partner program will encourage growth, but 85% of your partners cannot take advantage of the bait. You will have to assign different Partner Account Management resources to the three categories.

Group A is self-sustaining and need executive cowboys to grow beyond their own capabilities

Group B needs business development support and management coaching

Group C needs an online portal and a phone number.

Market segmentation

When scaling for dominance you need a tight-knit reseller network addressing various segments in the market. Channel competition is to your benefit, but you also need to ensure that partners develop deep niche competence to compete more effectively with your competitors.

You will recruit new partners based on your market coverage heat map and you will encourage current partners to specialize.

Ecosystem

You business will get much more “sticky” if you can turn your business model into a true “ecosystem”. With ecosystems you gain the contribution of all the market forces in improving both your product and your market awareness.

Your partner program will introduce ways for your partners to monetize their ecosystem participation. App stores, “certified for” and other programs are introduced to assist your partners in making money on top of your products.

Final note on the people you need in building, growing and managing a channel

Starting, growing and managing a partner channel require completely different skill sets.

Starting a channel requires salesmanship, entrepreneurship and business acumen. Your people must think on their feet and invent the Partner Program as they move along. They must be in the front line with the partner developing the business and closing the deals. We need cowboys to start a channel. It may not look pretty but the job gets done.

Starting a channel requires salesmanship, entrepreneurship and business acumen. Your people must think on their feet and invent the Partner Program as they move along. They must be in the front line with the partner developing the business and closing the deals. We need cowboys to start a channel. It may not look pretty but the job gets done.

Growing a channel requires lieutenants. You cannot change the Partner Program and the Partner Agreement for each new partner. You need people who can maneuver within the framework and not constantly change the framework. However, as we are still in business development mode we need commissioned officers to lead the endeavors and report back on issues that have global implications and that we must consider.

Managing a channel requires sergeants for the type C partners, lieutenants for the B type partners and executive cowboys for the type A partners.

Other articles in this series

- Successful Channel Building in The Software Industry

- The Best Process for Recruiting Channel Partners in the Software Industry

- What’s a best practice solution for managing channel partners in the software industry?

- Strategic partner development in the software industry

- Partner P&L – the path to productive partners in the software industry