Strategy for software Dummies – part 9

Strategy for software Dummies – part 9

The title for this series of posts is inspired by the extensive series of instructional/reference books, which serve as non-intimidating guides for readers new to the various topics covered, or for readers who needs a solid brush up. The title doesn’t imply that software CEO’s are Dummies; only that there is a need for a new type of “strategy framework” that produces more than fluff and which can be completed in a very short time.

This post #9 explain how the ABC Company perceives the market situation

A recap from post#8.

The ABC company is an Independent Software Vendor planning to go global. They have asked a ValuePerform consultant to help them put an international Go-To-Market plan together. The ValuePerform consultant wants to know the current position of the ABC company before any work on future strategies commences. It turns out that the management team wildly disagree on the priorities for financial performance. The consultant explains why the priorities must be set. After several internal meetings the management team come to a unanimous conclusion on how to prioritize the 6 sources of financial growth.

Each member of the ABC company management team is now given two times 15 questions. The management team also have very different perceptions of the Customer Value Proposition TODAY and in the FUTURE. Guided by the consultant the management team reaches the following conclusion:

The Customer Value Proposition TODAY and in the FUTURE

It is apparent that the ABC Company is heading for some major changes. Exactly which changes will be illustrated by answering a more comprehensive questionnaire. Before this questionnaire can be generated, the ValuePerform consultant asks each individual member of the management team to answer 4 questions concerning the market situation.

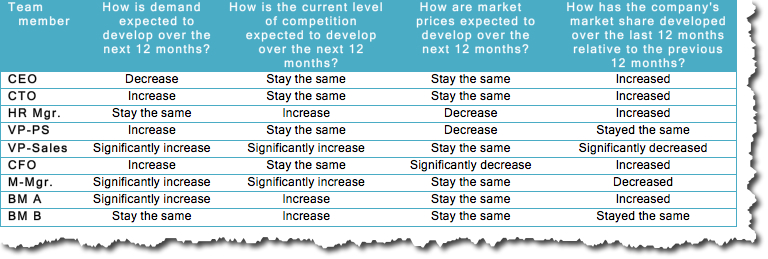

The 4 questions are:

- How is demand expected to develop over the next 12 months?

- How is the current level of competition expected to develop over the next 12 months?

- How are market prices expected to develop over the next 12 months?

- How has the company’s market share developed over the last 12 months relative to the previous 12 months?

The answers from the management team are:

The perception of the market situation

The members of the ABC Company management team obviously have very different perceptions of the current market situation.

Market demand

It turns out that the ABC company do not monitor and predict market demand. The CEO, the CTO and the CFO answered the question based on their gut feeling. The HR manager and Board Member B didn’t have any idea and provided the most neutral answer. The VP of Professional Services, the VP of sales, the marketing manager and Board Member B expected new markets to provide increased demand.

After reviewing this issue in general the conclusion is that market demand would probably stay the same.

Competition

The ABC company do not have a systematic process in place for monitoring the competition. However, the main difference in the perceptions is caused by two issues:

- Bringing a new product on to the market will open opportunities for competitors in the domestic market.

- Entering new markets will expose the company to new competitors.

After reviewing this issue in general the conclusion is that the level of competition will increase.

Market prices

The ABC company do not systematically monitor maker prices. The company has a solid track record of getting the prices they ask. After reviewing this issue in general the conclusion is that the price level will remain the same, but entering new markets will put the ABC Company in the challenger’s position and apply substantial pressure on the prices they can ask.

Market share

The ABC company do not systematically monitor market share, but the marketing department does make an estimation from time to time. The difference in the perception is mainly caused by the basis for the judgement: Domestic market versus the global market. As the company has not been active internationally it is highly unlikely that its global market share has increased. Domestically the market share has increased. After reviewing this issue in general the conclusion is that the global market share has decreased.

The next step

The ValuePerform consultant congratulates the management team. They have completed 11% of the strategy review. Based on the answers provided ValuePerform will now generate a questionnaire, which is specific to the situation of the ABC Company. The questionnaire will be submitted to each member of the management team by e-mail. It will take approx. 45 minutes to fill in the questionnaire and it requires the full attention of the respondent.

A full week has passed since the strategy review project started. Since we have to complete the project in two weeks the deadline for answering the questionnaire is set for the next day at 18:00. The next workshop has already been scheduled for coming Thursday from 08:00 – 18:00.

Other posts in this series:

Post #1: Strategy? – oh no, not again!

Post #2: Introducing ValuePerform – a lean approach for strategy analysis and alignment

Post #3: The 6 sources for financial growth

Post #4: Why do management teams disagree?

Post #5: Getting the priorities in place

Post #6: The Customer Value Proposition

Post #7: The Customer Value Proposition TODAY

Post #8: The Customer Value Proposition in the FUTURE

Post #9: The Market Situation

Post #10: ValuePerform and the 15 Management Areas

Post #11: What is important and what is not?

Post #12: How are we performing?

Post #13: Identifying the important and the urgent issues

Post #14: The Action Plan

Post #15: Why does misalignment occur?

Post #16: The price of management misalignment

Post #17: Avoiding invisible or suppressed misalignment

Post#18: The cost/benefit ratio of ensuring alignment