Entering a Foreign Market – Managing Extreme Niche Software Markets

Since I wrote the post “Entering a Foreign Market – The 9 Steps to Success for Software Companies” I have received a lot of positive feedback. Thank you very much to all who took the time to write me.

Since I wrote the post “Entering a Foreign Market – The 9 Steps to Success for Software Companies” I have received a lot of positive feedback. Thank you very much to all who took the time to write me.

A number of people have asked me how to manage the situation where your software solution addresses an extreme niche market.

This post is about this scenario.

Extreme niche markets – a definition

I’ll define an extreme niche market as a market with stochastic demand pattern.

Let me give a couple of examples.

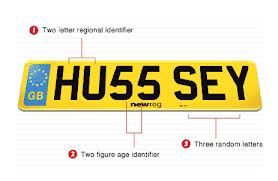

Example 1: Vehicle Registration & Management

Each country in the world has a Vehicle Registration & Management system. These systems are developed for each country’s government according to individual specifications. Such systems are only seldom replaced. The probability that a vendor can motivate a government to replace a current system is close to zero. Such replacements are decided by the political system and for political reasons every 10 to 15 years. There is an opening in each country every 10 – 15 years only.

Each country in the world has a Vehicle Registration & Management system. These systems are developed for each country’s government according to individual specifications. Such systems are only seldom replaced. The probability that a vendor can motivate a government to replace a current system is close to zero. Such replacements are decided by the political system and for political reasons every 10 to 15 years. There is an opening in each country every 10 – 15 years only.

Example 2: EMR systems for the healthcare industry

A public tender is currently open in Denmark for an integrated EMR system to support 40.000 healthcare workers servicing half of Denmark’s population (2.5M people). Two of the three shortlisted vendors are US-based (Epic and Cerner). When the vendor decision has been made the Danish “market” will be “closed” for a while. Four customers represent the Danish market for integrated EMR systems to hospitals. The process of preparing and executing a public tender for a new system takes at least 2 years. We are not aware of any plans for issuing a tender by any of the other 3 regions in Denmark, thus the Danish market may well closed for the next 3-5 years.

A public tender is currently open in Denmark for an integrated EMR system to support 40.000 healthcare workers servicing half of Denmark’s population (2.5M people). Two of the three shortlisted vendors are US-based (Epic and Cerner). When the vendor decision has been made the Danish “market” will be “closed” for a while. Four customers represent the Danish market for integrated EMR systems to hospitals. The process of preparing and executing a public tender for a new system takes at least 2 years. We are not aware of any plans for issuing a tender by any of the other 3 regions in Denmark, thus the Danish market may well closed for the next 3-5 years.

Example 3: Newspaper Management Systems

Producing and publishing newspapers takes place all over the world every day. The industry consists of 3.000 companies in 120 countries publishing 18.000 publications and running 15.000 online sites. The traditional newspaper industry is undergoing major changes competing for the attention of the consumers with other media and entertainment platforms. Although the changes should provide opportunities for insurgents the market is still dominated by a few incumbents with established relationships and deep domain insight.

Example 4: Capital Assets & Fund Management

The market for software systems supporting the management of large Capital Assets & Fund Management organization provides around 20-30 new projects every year. The most successful vendor (Danish SimCorp) may win half of these leaving only 50% of the market for the rest of the industry. An insurgent would face a market with only 10-15 open deals per year spread across the globe. Not exactly a dream scenario for making strategic decisions.

The market for software systems supporting the management of large Capital Assets & Fund Management organization provides around 20-30 new projects every year. The most successful vendor (Danish SimCorp) may win half of these leaving only 50% of the market for the rest of the industry. An insurgent would face a market with only 10-15 open deals per year spread across the globe. Not exactly a dream scenario for making strategic decisions.

Market Segmentation

The traditional approach of considering each country a specific market doesn’t work well for extreme niche markets. Thus the traditional approach of taking the domestic market first and then the neighbouring markets next may not work at all.

Only North America, representing close to 40% of the global demand for software solutions, will have active demand on a continuous basis in most niches. Even Japan (7.6%), Germany (5.7%), China (5.1%), the UK (3.9%), France (3.6%) and Italy (2.5%) may be too small to secure continuous demand in extreme niches.

Only North America, representing close to 40% of the global demand for software solutions, will have active demand on a continuous basis in most niches. Even Japan (7.6%), Germany (5.7%), China (5.1%), the UK (3.9%), France (3.6%) and Italy (2.5%) may be too small to secure continuous demand in extreme niches.

The Challenge

Selling domain specific solutions in extreme niche markets are by definition “high touch” type businesses. The sales processes are long and complex. There are often considerable legal and market specific functionality requirements, which must be met.

An insurgent with ambitions of moving into a new geographic market therefore face two main challenges.

- When should I invest in making legal and market specific functionality available so that I can compete effectively with the current incumbents?

- How do I invest in building the personal relationships with the potential customers thus allowing me to navigate when the process for acquiring new solutions become active?

There are no silver medals in sales.

A sales process may carry a very high expense tag that must be written off against other opportunities if you do not win the business.

Solution compliance

The insurgent will always prefer to combine the investment in country-specific functionality with winning the first order in that market. This preference is not only based on financial consideration, but also on the possibility of getting access to domain specific expertise for the specification of the functionality.

However, the first potential customer may be reluctant to accept the risk associated with a development project.

Building Relationships

Selling high-priced systems to people who don’t know you is very difficult. Implementing the type of solutions we are talking about in this post is always associated with considerable risk. Can the customer trust that you will and can allocate the resources required when things go wrong?

Bech’s 1st and 2nd Law Still Apply

Bech’s 1st law which asserts that the cost of sales increases exponentially with the distance to a market also applies to extreme niche markets.

Bech’s 2nd law which says that bigger markets are more difficult than smaller markets also applies to extreme niche markets.

The difference from the more normal markets is that you have fewer options for making strategic decisions. Whenever an opportunity is open in a market you have to consider if you should move in or not. If you ignore the opportunity, the next opportunity in that market will be even more difficult to win. If you go for this opportunity you will have to decline other opportunities as you do not have the resources to pursue all opportunities everywhere all the time.

Some benefits

There are also some benefits associated with extreme niche markets which actually make them more transparent.

Industry Associations

The demand side of extreme niche markets are normally well organized. Customers are members of local and global industry associations and meet frequently to discuss and exchange information. It is relative easy for the vendors to engage with potential customers and get insight on the competitive alternatives.

Market research

Business analysts monitor the market and provide regular reports on demand as well as the supply side. By putting money on the table you can normally get these analysts to make special reports on your solution, which then will be read by the potential customers.

KLAS Research is a good example of market research in the Healthcare Industry.

Seybold is a good example of market research in the publishing Industry.

Customer expectations

Customers in extreme niche markets are used to having access to a limited number of potential domain specific suppliers only. They are used to dealing with suppliers that cannot be expected to have an office around the corner.

Guidelines for entering a foreign market for extreme niche market insurgents

Giving generic guidelines for software companies serving extreme niche markets is more difficult than for more normal markets. However, having worked in this space for many years I do believe that some of the following observations may be valuable.

Monitor your potential customers

The number of potential customers in an extreme niche is small. You should have them all under surveillance in your CRM system.

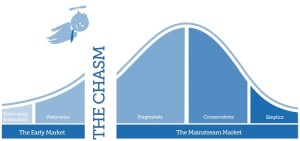

Crossing the chasm

When I sold my first software solution in the US, a person who was known to be a technology visionary in the industry supported my efforts. His agenda was to stir the local industry to become more innovative. A wake up call from a customer deciding on a solution from an alien insurgent would serve that purpose well.

When I sold my first software solution in the US, a person who was known to be a technology visionary in the industry supported my efforts. His agenda was to stir the local industry to become more innovative. A wake up call from a customer deciding on a solution from an alien insurgent would serve that purpose well.

Thus, this person helped me navigate the market. He helped me find the potential customer and he helped throughout the sales process. Without this person the sale wouldn’t have happened.

I didn’t know of Geoffrey Moore’s “Crossing the Chasm” principle back then (he hadn’t written the book yet), but my situation was similar to the challenges of introducing disruptive technologies.

My solution represented a new approach for optimizing the production and workflow in this industry. However, we only had few references, we were a small company and we had no presence in the US. We needed a customer who would weigh the potential of our technology higher than the risk of dealing with an insurgent.

Our Mahout led us to a customer where the management were also the owners of the business. Owners do not have to answer to anybody. If they make a mistake they may lose money, but they will not lose their jobs. Owners are in general more prepared to accept “reputation” risk than hired hands. The saying that “no one has ever been fired for choosing IBM” has little impact on owners.

Also “hired hands” are prepared to take risk, but I will claim that out of the 15% making up the early adopters of Moore’s “Crossing the Chasm” segment, the majority of the decision makers are owners.

Insurgents have to identity the early adopters. They cannot win the segment of the market where the first question asked is “who else that we know is using your system?”

Build alliances

Building alliances with bigger companies who can benefit from your success is a double-edged sword that has to be managed very carefully.

Building alliances with bigger companies who can benefit from your success is a double-edged sword that has to be managed very carefully.

The alliance partner has to approach you first. Someone with your alliance partner must see the opportunity for him/her and drive the development of the alliance forward.

In this scenario the alliance partners will typically be much bigger than you. They will throw tons of people at you. These people will change from time to time. The political agendas and the strategic whims of the alliance partner will change constantly and can be extremely hard to read.

However, they can be useful in helping you open a new market and win the first deals. Just as they may drop you overnight you should also be prepared (and able) to drop them when they are no longer needed.

The medium term perspective

Is an opportunity stand-alone or the gateway to more opportunities in the same market? Winning a deal in Norway will have the highest impact in Norway, some impact in Scandinavia, but little impact in Germany and no impact in Italy. If there are no more deals coming up in Norway or Scandinavia you may have won a pyrrhic victory.

Be cautious with “stand-alone” opportunities.

The long-term perspective

As you grow your global market share and thus your financial muscle you will become able to make more long term investment decisions. You will be able to make speculative investments in developing country specific functionality without a sponsor and hire local people to penetrate a major market with a longer perspective. It takes a considerable financial capacity to absorb the cost of running the operation with a loss for 3-5 years, but it may be the only alternative for gaining access.

Opportunities

In extreme niche situations you must be prepared to respond fast to genuine opportunities. The challenge is to qualify if an opportunity is “genuinely genuine.” Because extreme niche markets have very few vendors the potential customers will take considerable measures to create a competitive environment for major procurements. Thus an outspoken interest in your solution may be a cover up with the purpose of applying competitive pressure on the current (and preferred) supplier.

Navigating opportunities in extreme niche markets requires excellent sales skills.