Strategy for software Dummies – part 8

Strategy for software Dummies – part 8

The title for this series of posts is inspired by the extensive series of instructional/reference books, which serve as non-intimidating guides for readers new to the various topics covered, or for readers who need a solid brush up. The title doesn’t imply that software CEO’s are Dummies; only that there is a need for a new type of “strategy framework” that produces more than fluff and which can be completed in a very short time.

Post #8 explains how the ABC Company came to an agreement on their Customer Value Proposition in the FUTURE.

A recap from post#7.

The ABC company is an Independent Software Vendor planning to go global. They have asked a ValuePerform consultant to help them put an international Go-To-Market plan together. The ValuePerform consultant wants to know the current position of the ABC company before any work on future strategies commences. It turns out that the management team wildly disagree on the priorities for financial performance. The consultant explains why the priorities must be set. After several internal meetings, the management team come to a unanimous conclusion on how to prioritize the 6 sources of financial growth.

Customer Value Proposition TODAY

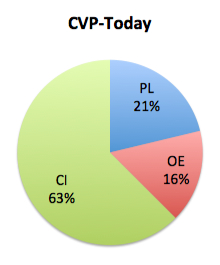

Each member of the ABC company management team is now given 15 questions. The answers will enable ValuePerform to illustrate how the individual member of the ABC management team perceived the Customer Value Proposition TODAY. It turns out that the ABC company management team does not agree on the Customer Value Proposition TODAY. The CEO, the CTO, the VP of sales, the marketing manager and a member of the board of directors, representing the various perceptions, are meeting separately to find common ground. Facilitated by the ValuePerform consultant they finally come to an agreement on the Customer Value Proposition TODAY.

The Customer Value Proposition is heavily dominated by the Customer Intimacy value element. Product Leadership is the second most important Value Element, while Operational Excellence is the least important Value Element.

The Customer Value Proposition in the FUTURE

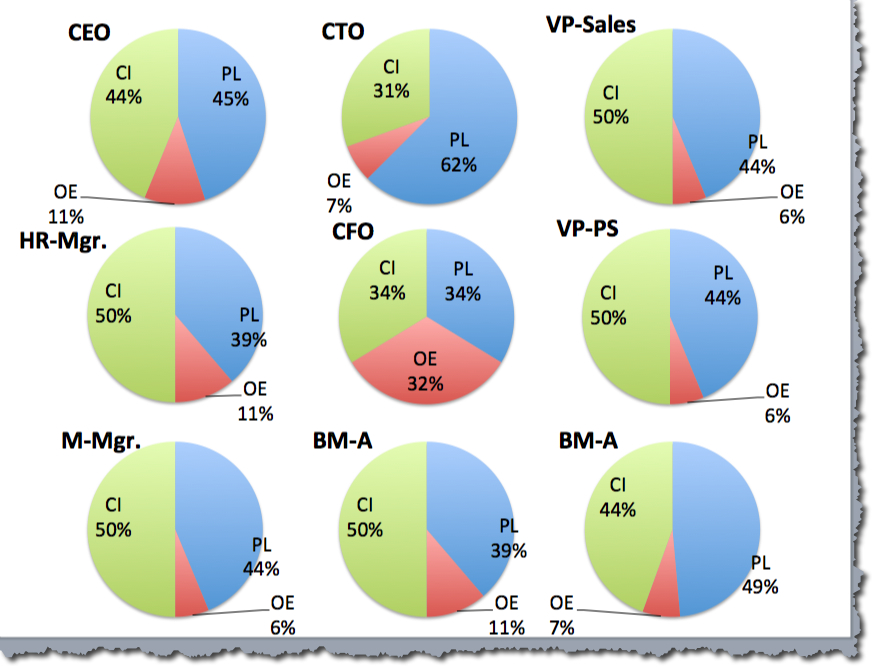

Each member of the management team is now given a questionnaire with 15 questions concerning the Customer Value Proposition for the FUTURE.

The outcome of the questionnaire is:

How the individual members of the ABC management team believe the FUTURE Customer Value Proposition should be

Comparing the perception of the Customer Value Proposition TODAY and in the FUTURE we notice two major differences:

1. There seems to be a more immediate consensus about the Customer Value Proposition in the FUTURE.

2. The Customer Value Proposition TODAY and in the FUTURE are very different.

The ValuePerform consultant asks each of the team members to motivate their positions. The general consensus is that the ABC company must be perceived as a Product Leader in the future. The reasons for this position are:

- It will be hard to convince existing customers to migrate to the new software if the product is not providing substantial value compared to the current version.

- New customers in the domestic market will be reluctant to accept the new product as the entire installed base is running on the current product. Substantial advantages are required for new customers to accept the new product.

- Moving into new markets will be difficult if the product is not superior to the solutions already available from local or international suppliers.

- It will be difficult to provide Customer Intimacy in new markets since this requires an established organization with domain competencies and product skills.

However, Customer Intimacy has been the value element making the ABC company successful. The management team is convinced that Customer Intimacy is still extremely critical and that the competitive position must be maintained through this value element.

The ValuePerform consultant points out that only the CTO gives the Product Leadership value more than 50% of the focus. Is it likely that the ABC company will become a product leader if this value element has less than 50% of the focus?

The discussion that follows is centred around the differences in the domestic market and in the new markets.

Changing the Customer Value Proposition in the domestic market from Customer Intimacy driven to Product Leadership driven will not be so difficult. The ABC company is the market leader and it will be possible to attract partners who can develop added functionality using the API of the new product. A high level of Customer Intimacy can be maintained through the current organization.

The situation in new markets is very different. If a high portion of Customer Intimacy is required to be successful, then this Value Element must be available from the start. How to deal with this challenge is delegated to the VP of sales and the VP of professional services.

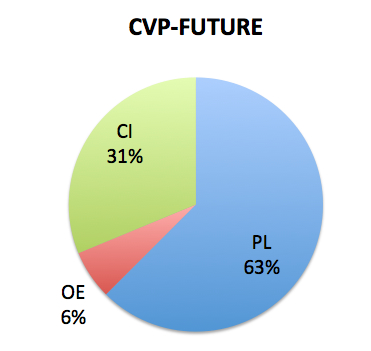

The ValuePerform consultant now asks the management team to answer the 15 questions together. Reviewing the 15 questions one by one the management team reaches the following conclusion:

The FUTURE Customer Value Proposition of the ABC company

The ValuePerform consultant emphasizes that the ABC company is up for some major changes. Exactly which changes will be identified in the questionnaire to follow. However before this questionnaire can be generated, 4 more questions must be answered.

The next post: The market situation in 4 questions.

Post #1: Strategy? – oh no, not again!

Post #2: Introducing ValuePerform – a lean approach for strategy analysis and alignment

Post #3: The 6 sources for financial growth

Post #4: Why do management teams disagree?

Post #5: Getting the priorities in place

Post #6: The Customer Value Proposition

Post #7: The Customer Value Proposition TODAY

Post #9: The Market Situation

Post #10: ValuePerform and the 15 Management Areas

Post #11: What is important and what is not?

Post #12: How are we performing?

Post #13: Identifying the important and the urgent issues

Post #14: The Action Plan

Post #15: Why does misalignment occur?

Post #16: The price of management misalignment

Post #17: Avoiding invisible or suppressed misalignment

Post#18: The cost/benefit ratio of ensuring alignment