Market Segmentation Fundamentals in the Software Industry – 3

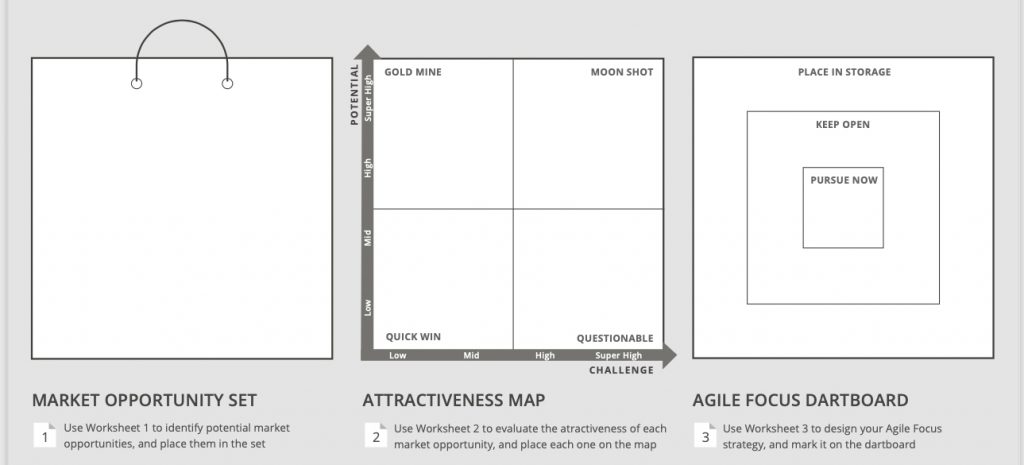

In September 2017, Marc Gruber and Sharon Tal published the book, “Where to Play – 3 Steps for Discovering Valuable Market Opportunities.” It may sound like a book for startups – which it also is – but it can be applied by anyone who finds their conversion rates too low or their revenue forecasts too shaky.

Article 1: How to get a one hundred per cent conversion rate on your cold calls.

Article 2: How to qualify potential customers to reduce the acquisition cost.

If your Ideal Customer Profile is the set of characteristics describing those customers that get the most value from your service or product, then how do you know that you have got them right?

In other words, how do you test and verify your Ideal Customer Profile?

You are looking for a balance between customer value on the one side and the customer acquisition cost (CAC) on the other.

The search for this balance makes many companies disqualify enterprise-type customers because of the latter’s complex and elongated decision-making processes. Selling to SMBs is considered a safer approach, since you can have more deals in the pipeline, and each of them closes faster than the big ones.

As a sales manager, I would be more comfortable with 1,000 potential deals worth one hundred thousand each than five possible deals worth 20 million each. All other things being equal, you can apply statistical probability to a thousand opportunities. You cannot do that for five potential projects.

Imagine that the average probability for the 200 potential deals out of the thousand that are to be closed this quarter is 75 per cent. Then I would be more comfortable forecasting revenue of ten million than if I had just one potential deal worth 20 million that also had a 75 per cent chance of closing. Even if the one deal was at 90 per cent, contract negotiations could still make it slip into the next quarter. It is doubtful that all the 200 potential sales would slip.

Over time I could learn how to apply the probabilities more realistically to the smaller deals, while it would remain very individual with the big ones.

The phenomenon described explains why many startups target the SMB market before moving upmarket to penetrate the enterprise segment. Also, when the value for enterprises may be much higher.

Where to play

In September 2017, Marc Gruber and Sharon Tal published the book, Where to Play – 3 Steps for Discovering Valuable Market Opportunities. It may sound like a book for startups – which it also is – but it can be applied by anyone who finds their conversion rates too low or their revenue forecasts too shaky.

The book fits nicely with the business model framework introduced by Alexander Osterwalder et al. and with The Lean Startup (which is also not only for startups) by Eric Ries and supported by Steve Blank.

You will find a couple of surprises in the book (such as a laser-sharp focus may not be the wisest practise). Still, in general, it presents a logical approach for finding the best market opportunities, which is the same as identifying your ideal customers given the resources you have available.

Where I find the book a little weak is on the verification of your assumptions and hypotheses. Discussions, yellow post-it notes, and whiteboard exercises are great, and so is desk research, and it will take you some of the way. However, when it comes to B2B software solutions, you eventually have to talk to your current and potential customers.

Real-life verification

Calling your current customers is not the big challenge. They know who you are and will respond.

Getting in touch with and getting a response from potential customers is an entirely different game.

Many companies underestimate what it takes to get through to potential customers and conclude meaningful conversations. Most of the time is used to reach out to people who are not available and do not respond. When you eventually get in touch with someone, the rejection rate is overwhelming. You can do much to optimise your outbound approaches, but you cannot eliminate what appears a waste of time and substantial rejection.

In most cases, my conclusion is that B2B software companies are better off outsourcing this portion of the market validation to a specialised service provider.

“You’ll be surprised how often suppliers misunderstand what motivates customers to buy their products and services,” says Stefan Avivson. “There is much second-guessing going on, and mostly the assumptions made are way off the mark.”

Stefan Avivson is the founder and CEO of BMoreRaw. His company specialises in helping companies achieve Product-Market-Fit and identify the positioning statements that provide the highest conversion rates and gross margins.

“You must hear it from your customers,” stresses Stefan Avivson. “If you are a startup with no customers, then you need to talk to your potential customers pretending that you want to sell them something. I know this does not come as a surprise to anyone, but most companies don’t have the staff that can consistently perform such activities.”

Stefan’s approach fits nicely with the Where to Play method. Whenever you have identified a market opportunity and undertaken your desk research, you can pass it on for the ultimate test using the BMoreRaw method.

“We have the resources that can complete one hundred customer contacts,” says Stefan Avivson, “and we pretend that we want to sell the customer something. If you don’t apply this type of pressure, you will not get honest answers. People are, in general, nice and will appear interested and positive if there is no price tag associated. You must give people a reason to say no. Otherwise, the yeses have no value.”

Scaling and conversion rates

As rightly emphasised in the Where to Play book, many companies scale too soon. They believe they have product/market fit and start scaling the revenue generation efforts. However, conversion rates remain unstable, and revenue forecasts constantly fail to deliver.

“The situation is especially critical when most of the revenue generation effort is left with individual salespeople,” stresses Steen Helmer, a partner at TBK Consult. “Some salespeople perform well, and some don’t, and you have a hard time putting your finger on what makes the difference. Such situations are difficult to assess. Do you have a people or a product/market fit problem? Or maybe a combination of these?”

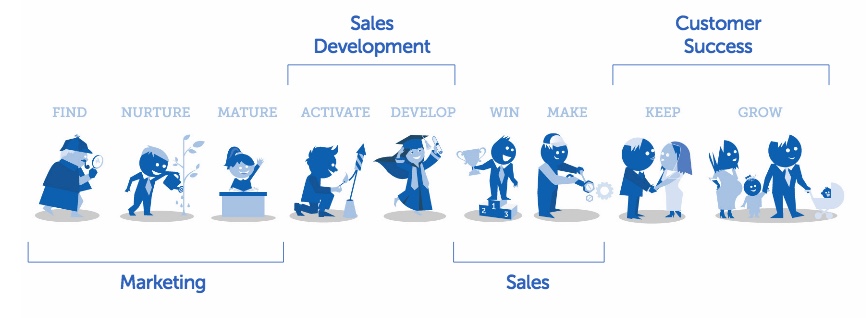

Realising that the skills required to master the entire revenue generation process from brand-building to closing deals are rarely present in a single individual, many companies have introduced the division of labour and assigned the many steps to separate teams. By identifying the steps in the customers’ buying journeys and the corresponding steps in the sales process, it becomes possible to measure conversion rates and test ways of improving them.

“Although we all want to employ the best talent we can find, we do not want super performers whose magic we do not understand,” says Steen Helmer. “By separating the various steps in support of our customers’ buying journeys, we can draw on a much larger pool of talent, outsource some of the steps, call on external expertise and fine-tune them one by one.”

The revenue generation process consists of several steps, just like all other business processes. The differences from R&D, logistics, production and administration are that external factors outside our control highly impact revenue generation. Much of the information we need to assess productivity and make reliable forecasts are based on the interpretation of qualitative and quantitative data.

“Considering revenue generation as a process with many steps is a great start when you prepare for scaling,” says Steen Helmer. “It allows us to work with each step at a time, and we can separate what was previously just noise from the market into meaningful feedback on our initiatives. When we can prove that something works, then we can scale. But we still need to monitor the conversion rates because revenue generation will never become an exact science, and the environment in which we operate keeps changing.”