Strategy for software Dummies – part 3

A strategy framework for growing a software company from a local to a global player

The title for this series of posts is inspired by the extensive series of instructional/reference books, which serve as non-intimidating guides for readers new to the various topics covered, or for readers who need a solid brush up. The title doesn’t imply that software CEO’s are Dummies; only that there is a need for a new type of “strategy framework” that produces more than fluff and which can be completed in a very short time.

This post #3 illustrates how to get started using the ValuePerform framework and how quickly it can create tangible results.

A small recap from post#2.

The ABC company is planning to go global. They have asked a ValuePerform consultant to help them put an international Go-To-Market plan together. The ValuePerform consultant wants to know the current position of the ABC company before any work on future strategies commences.

The Workshop

A 1/2 day workshop has been organized to get some fundamental concepts confirmed. The ValuePerform consultant has, prior to the workshop, submitted a questionnaire to each participant with 60 questions concerning the current situation as well as their expectation for the future.

The 60 questions are described in detail in “The Magical 10 minutes” a series of 7 blog posts on management alignment. The 60 questions cover the 6 sources of financial performance, the customer value proposition today/tomorrow and an assessment of the current market situation.

With the questionnaire followed an explanation of the requirement for setting priorities and a description of the value elements in a customer value proposition.

Setting the priorities

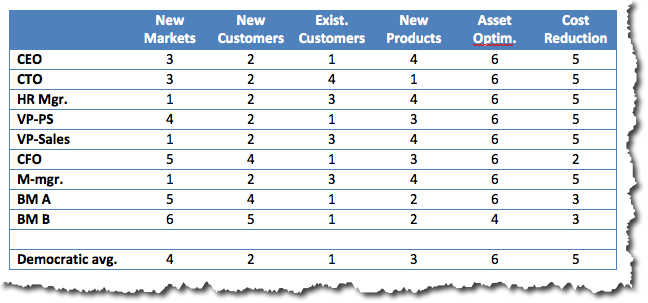

At the workshop, the ValueMaker consultant presents the answers provided by the 9 participants in the group. He starts with showing how each member of the group perceives the priority of the 6 sources of financial performance:

- Revenue growth in new markets. A new market is a market or market segment where you are not recognized as a player. A new international market is also a new market even though you already have a recognized position in a similar market somewhere else. Thus if you have a 75% market share in a certain market in Norway, entering the same market segment in Germany counts as a new market.

- Revenue growth from new customers. New customers are customers with whom you do not have a current business relationship. If your top priority is to move into new markets, new customers should be #2.

- Revenue growth from new products. New products and services are either complementary modules to your current offerings or completely new products or services. Minor improvements and extensions to current products for which you do not charge an additional price are not considered new products.

- Revenue growth from existing customers. Existing customers are customers with whom you have a current commercial relationship (which means that you send your customers invoices and the customers pay them).

- Optimise asset utilization. Independent Software Companies seldom perceive themselves as “asset” companies. However, many ISVs have assets that they are not aware of. Your channel of resellers is an asset. Your Intellectual Property Rights are your assets.

- Improve the cost structure. The cost base is primarily the operational expense associated with running your business and the cost of goods sold associated with producing your products and services.

The priorities are quite different:

Individual priorities of the 6 sources of financial performance

The CEO recognizes that growing internationally is important in the future, but he is concerned with moving too much focus away from the existing customers. Existing customers account for more than 75% of current revenue and with increasing pressure from new competitors, he feels that the first priority must be protecting the existing customer base.

The CTO believes that the highest priority must be given to the new platform, which is to be released in the middle of 2012. The new platform is not compatible with the current product and we must ensure that existing customers migrate as soon as possible.

The HR manager, which was hired 6 months ago, understood that international expansion was the most important.

The VP of Professional Services was currently working closely with the CTO preparing the support staff for the new product. As the new product had been developed in close relationship with current customers, he was convinced that priority #1 was to secure the new product platform with existing customers.

The VP of sales, who joined the company 8 months ago, was chosen for his international experience. Taking the company international was his primary objective. Thus New Markets and New Customers were his top priorities.

The CFO was concerned with the increasing cost of the company. The restructuring of the sales department and the expansion of the marketing function had been expensive. Also, the recent build-up of an offshore development centre had been expensive The return had not yet materialized. “We must keep an eye on the expenses.”

The marketing manager, who was brought on board 5 months ago, was preparing for international activities and thought the international project was the most important.

Board Member A was concerned with the internationalization project. He was not sure the ABC company was ready for such a journey. He believed that focusing on the current business was critical including getting the new product platform to the market. More time was required to prepare plans for the international activities.

Board Member B agreed with board member A but found that the company should explore OEM opportunities for the software. “There must be software companies out there, which have old technology, and could benefit from replacing their outdated platforms with our new technology.”

The discussion quickly came to a consensus that the 6 sources could be grouped into two groups A and B. The sources of growth in each group could then be of equal importance.

The ValuePerform consultant told the group that no further work could be accomplished before a clear decision had been taken on the priorities. “If you cannot come to an agreement, someone must set the priorities. A group A and group B may sound like a nice compromise, but this is not a parliament. This is a business, and in business you need clear priorities.”

The group left it to the CEO and the VP of sales to settle the priorities and moved on to the next issue.

Post #1: Strategy? – oh no, not again!

Post #2: Introducing ValuePerform – a lean approach for strategy analysis and alignment

Post #4: Why do management teams disagree?

Post #5: Getting the priorities in place

Post #6: The Customer Value Proposition

Post #7: The Customer Value Proposition TODAY

Post #8: The Customer Value Proposition in the FUTURE

Post #9: The Market Situation

Post #10: ValuePerform and the 15 Management Areas

Post #11: What is important and what is not?

Post #12: How are we performing?

Post #13: Identifying the important and the urgent issues

Post #14: The Action Plan

Post #15: Why does misalignment occur?

Post #16: The price of management misalignment

Post #17: Avoiding invisible or suppressed misalignment

Post#18: The cost/benefit ratio of ensuring alignment